What Is a Cash Receipt? A Quick Guide

At its core, a cash receipt is simply a piece of paper that proves a customer paid you in cash for goods or services. It’s the official proof of purchase, a small but mighty document that protects both you and your customer by creating a physical record of the sale.

Even with the rise of digital payments, cash isn't going anywhere. It’s still a huge part of how many small businesses operate every single day.

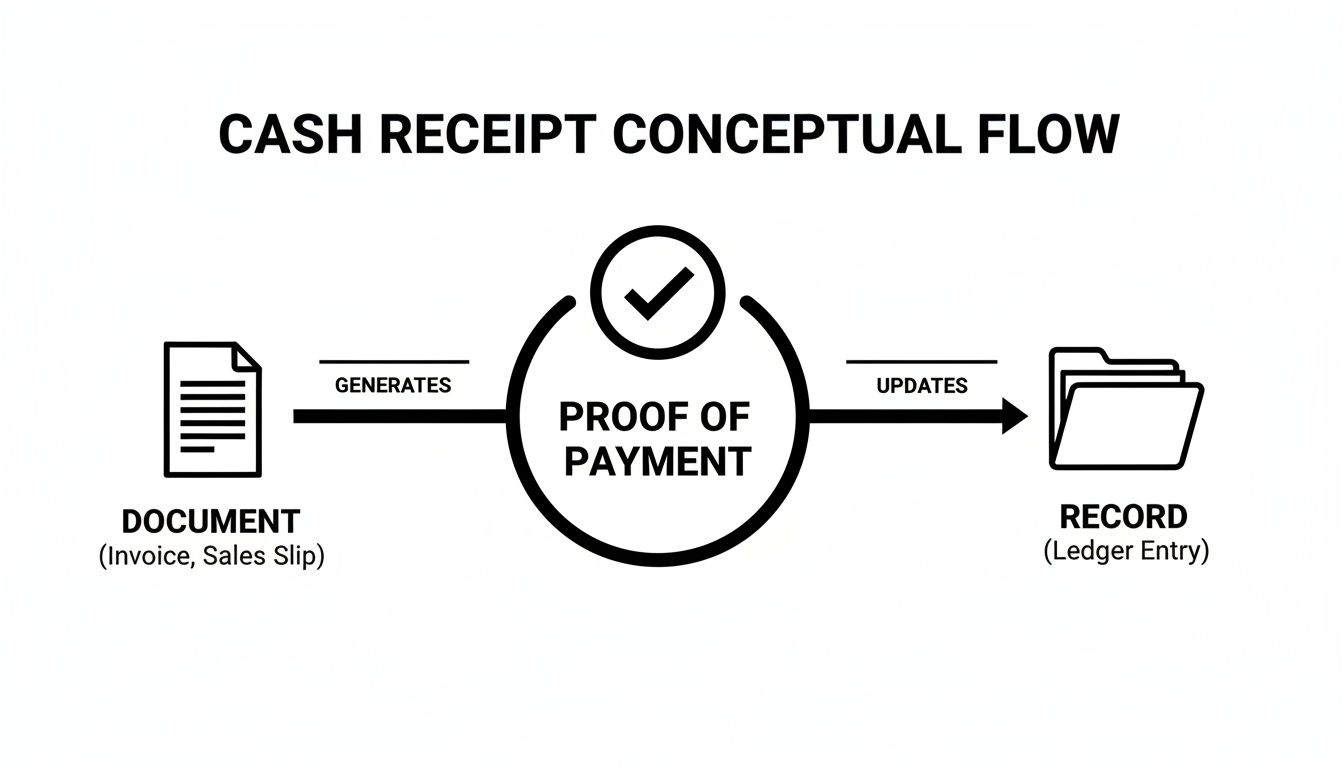

To get straight to the point, here’s a simple breakdown of what a cash receipt really does.

Quick Answer: What Is a Cash Receipt

| Aspect | Simple Explanation |

|---|---|

| Purpose | To prove that a cash payment was received. |

| Who Issues It | The seller, to the buyer. |

| When It's Issued | Immediately after payment is made. |

| Key Function | Acts as a record of a completed transaction. |

This simple document is the final step in a cash sale, confirming the deal is done and the money has changed hands.

Understanding the Role of a Cash Receipt

Think of a cash receipt as the final handshake after a sale. It’s not an invoice, which asks for money. Instead, it’s the official "thank you, we've received your payment" confirmation. This little piece of paper is a fundamental part of good bookkeeping for any business, whether you’re running a pop-up coffee stand or working as a freelance handyman.

Getting into the habit of issuing and tracking these receipts helps you monitor your income, manage cash flow, and keep your accounting records straight. It’s the first building block for a solid financial picture, and skipping this step can lead to a mess of confusing reports and a serious headache come tax time.

Why This Document Is So Important

A cash receipt does a lot more than just confirm a sale. It plays a few crucial roles that are vital for protecting your business.

- It Builds Customer Trust: Handing over a receipt is a sign of professionalism. It gives your customers a record for their own books, making it easier for them to handle returns or track expenses.

- It Guarantees Financial Accuracy: This is a source document for your accounting. It helps you track every single dollar coming into your business, leaving no room for guesswork.

- It Offers Legal Protection: If a dispute ever comes up about whether a payment was made, a signed cash receipt is your hard proof that the transaction was settled.

To get a full picture of your cash flow, it’s also helpful to understand what a cash disbursement is—which is just the opposite, tracking money leaving your business. Depending on the situation, you might use a straightforward Cash Sale Receipt Template for daily sales or a specific Donation Receipt Template if you're a non-profit.

The Anatomy of a Perfect Cash Receipt

A proper cash receipt is so much more than a crumpled piece of paper with a number scrawled on it. Think of it as a formal, professional document—a blueprint for financial clarity. Each part plays a specific role, giving it real legal and financial weight for every single transaction.

Even with all the new ways to pay, cash is still king in many parts of the world. A McKinsey Global Payments Report found that cash made up a staggering 46% of payments worldwide, covering about 3.6 trillion transactions. That number alone shows just how crucial it is to get your cash receipts right. If you're curious, you can read more about global payment trends on McKinsey.com.

Every piece of information on a cash receipt helps turn it from a simple note into a valid financial record.

This diagram really simplifies it: the receipt starts as a document, acts as proof of the transaction, and finally becomes a permanent part of your financial records.

Key Components Every Receipt Needs

For a cash receipt to do its job properly, it needs a few non-negotiable elements. If you miss any of these, you risk weakening its value for bookkeeping, tax audits, or even settling a customer dispute. Let's break down what every professional receipt should have.

Here’s a quick reference guide to the essential parts of any cash receipt and why they matter so much.

| Component | Description | Why It's Important |

|---|---|---|

| Your Business Info | Your official business name, address, and phone number. | Clearly identifies you as the seller and legitimizes the document. |

| Unique Receipt Number | A sequential number (e.g., #001, #002, #003) assigned to each transaction. | Prevents duplicate entries and makes it easy to track every sale in your accounting system. |

| Transaction Date | The exact date the sale took place. | Crucial for accurate financial reporting, inventory management, and tax filing periods. |

| Itemized List | A breakdown of each product or service sold, including the quantity and price for each. | Provides a clear record of what was purchased, which is essential for returns or disputes. |

| Payment Details | The subtotal, any taxes applied (like sales tax or VAT), and the final total amount paid. | Creates a complete financial picture of the transaction for both you and the customer. |

| Payment Method | A simple note indicating the payment was made in "Cash." | Confirms the transaction type and helps with reconciling your cash drawer at the end of the day. |

Having these components in place ensures your receipts are professional, compliant, and useful.

Think of it this way: a complete and accurate cash receipt is your first line of defense in an audit and the bedrock of a trusting relationship with your customers. It's a clear signal that you run your business with transparency and care.

An itemized list of what was sold is especially vital. For instance, any good Simple Cash Receipt Template will provide dedicated space to detail each item and its cost. This is even more critical for service-based businesses, where a Service Receipt Template needs to clearly outline the work performed. Finally, including the subtotal, taxes, and grand total ties it all together into one clear financial snapshot.

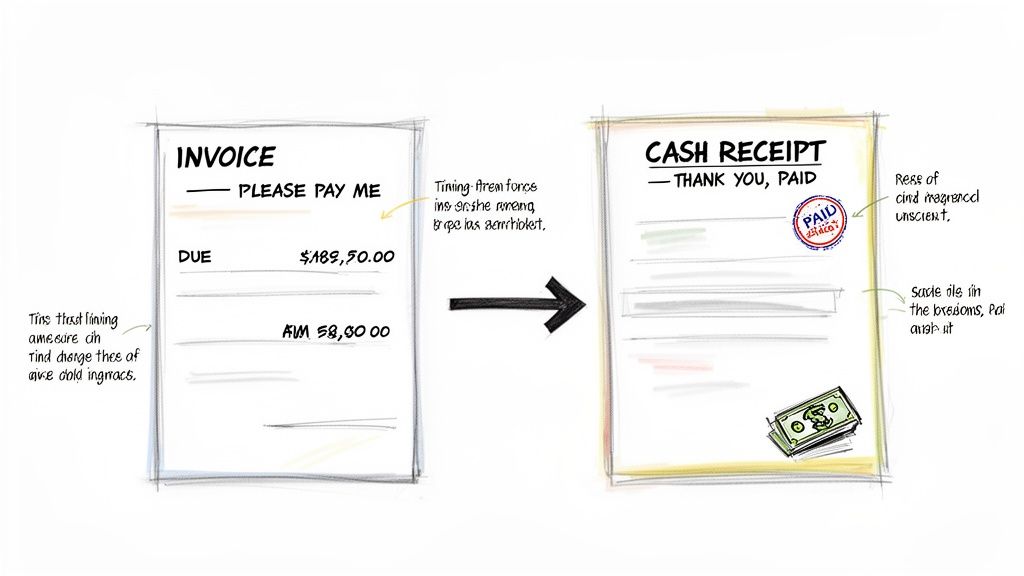

Cash Receipt vs. Invoice: Understanding the Difference

It’s a common mix-up for new business owners, but cash receipts and invoices serve completely opposite functions in a transaction. Getting them right isn't just about looking professional; it's crucial for keeping your books clean and communicating clearly with customers.

Think of it this way:

An invoice is a request. It says, "Here's what you owe me."

A cash receipt is a confirmation. It says, "Thanks, you've paid me."

Simple, right? The invoice kicks off the payment process, and the cash receipt officially closes it out.

This core difference in purpose dictates everything else, especially the timing. You always send an invoice before the customer pays. The cash receipt only comes into play after you have the money in hand.

Cash Receipt vs Invoice at a Glance

To make it even clearer, let's put them side-by-side. This quick comparison table highlights the key distinctions every business owner should know.

| Feature | Cash Receipt | Invoice |

|---|---|---|

| Purpose | To confirm a payment has been received. | To request payment for goods or services. |

| Timing | Issued after payment is made. | Sent before payment is due. |

| Financial Role | Acknowledges income already in your account. | Creates an account receivable (money owed). |

| Call to Action | None; the transaction is complete. | Specifies payment terms and a due date. |

At the end of the day, an invoice opens the financial dialogue, and a cash receipt concludes it.

For instance, a freelance photographer sends an invoice after a photoshoot. Once the client settles the bill, the photographer issues a cash receipt as the final proof that the account is paid in full. This creates a perfect paper trail. Using a professional Service Receipt Template makes this final step quick and easy, but you can also find a good General Receipt Template for all sorts of situations.

Why Keeping Cash Receipts Is a Non-Negotiable for Taxes

When it comes to your business finances, think of organized cash receipts as your best line of defense. They aren't just good bookkeeping; they're the hard proof that tax agencies like the IRS demand for every single expense you claim. A valid cash receipt is the gold-standard evidence that a transaction actually happened.

Without that proof, you’re taking a huge risk. An auditor could easily disallow legitimate deductions, which often leads to painful penalties. On the flip side, proper documentation lets you calculate profits correctly, file taxes with confidence, and legally claim every deduction you're entitled to. It's the foundation of a financially sound and compliant business.

Maximizing Deductions and Proving Expenses

Every time you pay for office supplies, a client lunch, or travel with cash, that little piece of paper is a potential tax deduction. Each one is a real business cost that can lower your taxable income, and forgetting to track them is like throwing money away.

The scale of cash transactions is just massive. To give you some perspective, U.S. farm cash receipts alone hit a staggering $535.2 billion. And with errors in cash documentation plaguing 30-40% of small retailers, you can see how critical getting it right is. You can explore more data on farm sector income from the USDA to get a sense of just how big these numbers are.

Beyond taxes, accurate receipts are crucial for managing expense reimbursements for your team or even for yourself. A clear paper trail is an absolute must. If you need some pointers on staying compliant, this UK Guide to Expense Reimbursement is a great resource.

A shoebox full of faded receipts is an auditor's nightmare and a business owner's liability. Organized, detailed cash records are your first and best line of defense, turning potential chaos into clear, defensible proof of your business activities.

Beyond Taxes: Customer Disputes and Returns

Your responsibility doesn't just stop at tax time. Cash receipts are also incredibly useful for smoothing out daily operations and protecting your business from headaches.

Here’s how they provide an extra layer of security:

- Handling Returns: A receipt instantly proves when and where an item was purchased, which makes returns or exchanges simple and straightforward.

- Warranty Claims: For any product that comes with a warranty, the receipt acts as the official starting pistol for the coverage period.

- Resolving Disputes: If a customer ever questions a payment, having a signed copy of the receipt can end the argument on the spot.

Using a clear format like a Simple Cash Receipt Template ensures you capture all the key details, protecting both you and your customer. For more specific situations, something like a Cash Payment Receipt Template can be the perfect fit.

How to Create Professional Cash Receipts in Minutes

Ready to ditch the messy, handwritten notes and start looking like the pro you are? Creating a clean, official cash receipt is surprisingly easy, and it’s one of the fastest ways to build trust and credibility with your customers.

While you could still use an old-school receipt book, digital tools are just so much faster and more polished.

The quickest route to a perfect receipt is using an online generator. A tool like ReceiptMake.com lets you create a flawless document in about three simple steps, saving you a ton of time. It’s a great way to make sure you’ve included all the essential details without any guesswork.

A Simple Three-Step Process

Making a receipt online is incredibly straightforward. You don't need to be an accountant or a tech whiz to get a fantastic result.

- Pick a Template: First, just choose a design that matches your business. A good generator will have plenty of options, from a Simple Cash Receipt Template for basic transactions to a more specific Retail Receipt Template for store sales.

- Fill in the Blanks: Next, plug in the key transaction info—who you are, who the customer is, what they bought, and the total amount they paid. The best tools will even calculate the subtotals and taxes for you.

- Download and Go: Once everything looks right, you can instantly download a high-quality PDF. From there, you can print it out on the spot or email it directly to your customer for a clean digital record.

This simple workflow takes what used to be a chore and turns it into a quick, professional part of your sales process.

A cash receipt is the unsung hero of financial accountability, a clear record issued when cash changes hands. Early versions, known as 'billheads,' were used by British shopkeepers in the 18th century and became standard after the Industrial Revolution. Learn more about the historical role of accounting practices to see how these documents evolved.

So, whether you’re a nonprofit that needs a Donation Receipt Template or a freelancer who just got paid for a project, using a digital tool helps you look professional and keeps your records perfectly organized.

Common Questions About Cash Receipts

Let's wrap things up by tackling a few questions I hear all the time from business owners. Getting these details right can save you a lot of headaches down the road, so here are some clear, straightforward answers to help you feel confident about your record-keeping.

Do I Need a Receipt for Every Small Cash Sale?

I get it—stopping to write up a receipt for a $2 sale can feel like overkill. But trust me on this: it's a habit worth building. For your own bookkeeping sanity and for tax purposes, having a complete record of every single sale is your safest bet.

This simple practice helps you track your real income and stops those frustrating little discrepancies from piling up. When it's time to balance the books, you'll be glad you have an unbroken trail of financial data.

Can a Cash Receipt Be Handwritten?

Absolutely. A handwritten receipt is perfectly valid in the eyes of the law, as long as it’s legible and has all the key info. You still need the date, the amount paid, your business details, and a quick description of what was sold.

That said, using a digital template just looks more professional and seriously cuts down on the risk of errors or handwriting that no one can decipher. A clean General Receipt Template ensures you won’t forget any of those critical details.

Key Takeaway: Both handwritten and digital receipts work, but digital versions offer a big leg up in professionalism, accuracy, and simple storage. Whatever you choose, just be consistent.

How Long Should My Business Keep Cash Receipts?

Tax agencies like the IRS have specific rules on this, generally suggesting you keep business records for three to seven years. My advice? Play it safe. A good rule of thumb is to hold onto all your cash receipts for at least seven years.

This way, you're fully covered if you ever face an audit. Plus, storing them digitally is a massive relief compared to keeping boxes of paper receipts that fade over time.

Is a Sales Receipt the Same as a Cash Receipt?

This is a classic point of confusion, but the difference is pretty simple. Think of "sales receipt" as the big umbrella category.

A "sales receipt" is any document that proves a purchase happened, whether it was paid for with a credit card, a bank transfer, or a digital wallet. A "cash receipt," on the other hand, specifically confirms the payment was made with physical money.

So, every cash receipt is a type of sales receipt, but not all sales receipts are cash receipts. Understanding this helps, whether you're using a specific Cash Payment Receipt Template or just keeping your records straight.

Ready to create flawless, professional cash receipts in seconds? With ReceiptMake, you can generate, download, and send perfect receipts for any transaction without any sign-up required. Choose from over 100 templates and make your business look its best. Try the free receipt generator today