How to Write a Receipt for Money: A Practical Guide

Knowing how to write a receipt for money is about much more than just scribbling down a number. It’s about creating a clear, professional record of a transaction. The best receipts always nail the key details: seller and buyer information, the date, an itemized list of goods or services, the total amount paid, and the payment method. When you get these elements right, a simple piece of paper becomes an essential business tool.

Why a Proper Receipt Is More Than Just Paper

Think of a well-written receipt as your business's final handshake—it builds trust and confirms that a deal is officially done. If you're a freelancer, run a small shop, or handle cash payments, a proper receipt isn't just proof of purchase. It's a mark of credibility that shows clients you're serious about your work. It’s the official closing chapter of a sale that protects everyone involved.

A vague, handwritten note can quickly become a real headache. An incomplete receipt can easily lead to disputes over payment amounts or dates, creating friction with customers you really don't need. Taking a moment to document a transaction professionally prevents these misunderstandings before they can even start.

The Real Cost of Poor Documentation

Sloppy or manual receipt-keeping comes with significant risks and costs. Believe it or not, invoice errors creep into 39% of all documents, and a lot of those stem from messy, hard-to-read handwritten records. Small businesses and contractors feel this pain the most, with manual processing taking an average of 14.6 days and costing around $15 per document.

A clear, detailed receipt is your first line of defense in any payment dispute. It eliminates ambiguity and provides concrete proof of the transaction, saving you time, money, and stress down the road.

To truly grasp why this matters, it helps to understand the fundamental difference between an invoice and a receipt. An invoice is a request for payment; a receipt is the proof that payment was made.

Building Trust and Staying Organized

Beyond preventing disputes, accurate receipts are absolutely crucial for your own financial tracking and tax compliance. They are the backbone of your bookkeeping, helping you monitor cash flow and prepare for tax season without that last-minute scramble for information.

A consistent and professional approach to your receipts signals reliability. Whether you're making a basic cash payment receipt or a more detailed service receipt, the effort you put in shows a commitment to transparency and solid business practices.

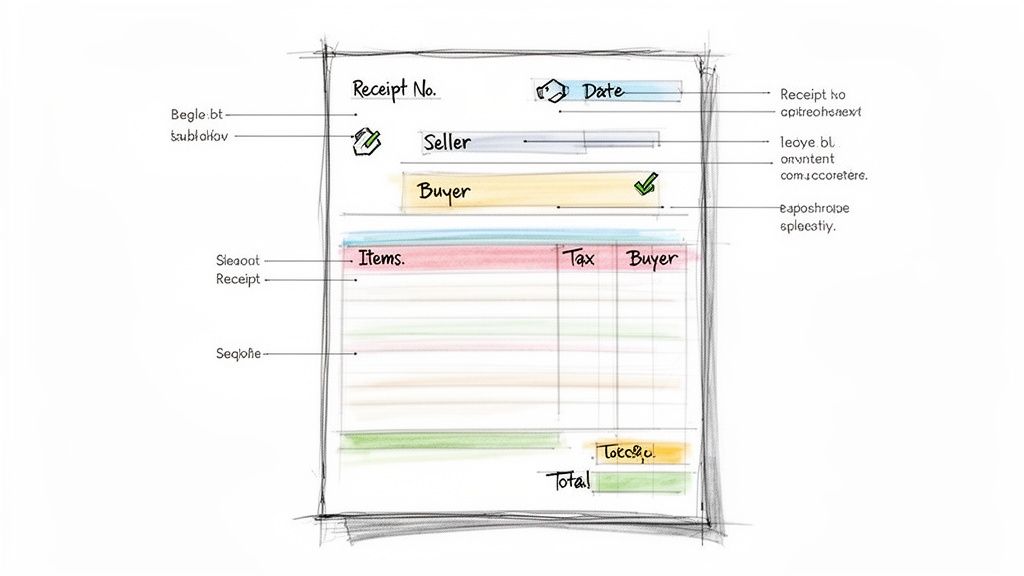

The Anatomy of a Perfect Receipt

Knowing how to write a good receipt isn't just about jotting down a number. A truly effective receipt tells the complete story of a transaction, leaving no room for guesswork. I've seen simple, handwritten notes cause major headaches down the line because a key detail was missing. Get it right, and you have a clear, professional, and legally sound document.

Think of it as assembling a puzzle. Each piece has a specific job, and when they all click together, you create a complete picture that protects both you and your customer. Let's walk through those essential pieces one by one.

To help you get started, here's a quick rundown of the absolute must-haves for any receipt you create.

Essential Elements of a Valid Receipt

| Component | What to Include | Why It's Important |

|---|---|---|

| Your Info | Business name, address, phone/email. | Identifies you as the seller and makes you look professional. |

| Customer Info | Their full name or business name. | Officially links the payment to a specific person or entity. |

| Date | The exact date payment was received. | Critical for bookkeeping, tax deadlines, and tracking payment history. |

| Receipt Number | A unique, sequential number (e.g., 001, 002). | Makes every single transaction traceable and prevents confusion. |

| Itemized List | A clear breakdown of each product or service and its cost. | Provides total transparency and avoids "what did I pay for?" questions. |

| Financials | Subtotal, any taxes or fees, and the final grand total. | Shows exactly how the final amount was calculated. |

| Payment Method | How they paid (e.g., Cash, Credit Card, PayPal). | Adds another layer of proof for financial record-keeping. |

Getting these basics right every time is the foundation of solid financial documentation for your business.

Identifying the Key Players and Dates

First things first, every receipt needs to clearly state who was involved. It sounds basic, but you'd be surprised how often this gets glossed over, especially on quick, handwritten notes.

- Your Information: This means your business name (or your own name if you're a freelancer), address, and a way to get in touch. It officially establishes you as the seller.

- Customer Information: Always include the buyer’s full name or their company's name. This creates a direct link between them and the payment, which is crucial for both of your records.

- Transaction Date: This is non-negotiable. Pinpoint the exact date the money changed hands for accurate bookkeeping.

I also can't stress this enough: add a unique receipt number. It's such a simple thing to do but incredibly powerful. A simple sequential system—001, 002, 003—makes every transaction easy to find and reference. Trust me, if you ever face an audit, having a unique number for every payment can save you from a world of trouble.

A well-structured receipt acts as a silent witness to a transaction. Its clarity and completeness can instantly resolve potential disputes over what was paid, when it was paid, and what was provided in return.

Detailing the Goods and Calculating the Total

Now we get to the heart of the receipt—the part that explains exactly what the customer bought. Vague descriptions are your enemy here.

Start with an itemized list of products or services. Be specific. Don't just write "Consulting." Instead, put down "5 Hours of SEO Consulting." If you sold physical goods, list each one on its own line with the price next to it. This kind of transparency builds trust and reminds the customer of the value they got.

Once you’ve listed everything, calculate the subtotal. Then, if you have to add sales tax or other fees, make sure they get their own separate lines. This shows the customer you aren't just pulling numbers out of thin air.

Finally, show the grand total in big, bold letters. It's also a great idea to note the payment method (Cash, Credit Card, PayPal, etc.). This adds another useful detail for your financial records. Using a clean layout, like the one in this generic POS receipt template, is a great way to make sure you never miss a beat.

Crafting Receipts for Real-World Scenarios

Knowing the basic parts of a receipt is a great start, but the real skill comes in knowing how to write one for all the different situations you'll face. The wording you use for a quick coffee sale is worlds away from what you’d need for a monthly rent payment.

Let’s get practical. A one-size-fits-all approach just doesn’t work because every transaction has its own unique details that need to be captured. Getting these specifics right protects everyone involved and keeps your records straight.

For Retail Sales and Products

When you sell something tangible, the receipt has to be perfectly clear about what walked out the door. Vague descriptions like "General Merchandise" are a recipe for headaches, especially when a customer comes back for a return or has a warranty question.

- Item Description: Get specific. Instead of just "Clothing," write "1x Men's Blue Cotton T-Shirt, Size L." If you have SKUs or model numbers, add them.

- Pricing: Always list the price for each item on its own line. That kind of transparency builds trust and makes handling returns so much easier.

- Returns Policy: It’s a good idea to add a simple line at the bottom, like "Returns accepted within 30 days with receipt."

This level of detail turns a simple piece of paper into a genuinely useful document for your customer. If you’re handling a lot of sales, using a good retail receipt template is a game-changer for keeping things consistent and looking professional.

For Rental Payments

For landlords and tenants, the rent receipt is one of the most important documents you'll handle. It's the official proof that rent was paid on time, and missing a key detail can spark a serious dispute later on.

The description is where you need to be meticulous. It absolutely must state:

- The property address, including the unit number (e.g., "Rent for 123 Main Street, Apt 4B").

- The exact payment period (e.g., "For the period of May 1, 2024 - May 31, 2024").

- Any extra charges, like late fees or utilities, which should be listed as separate line items.

A clear, detailed rent receipt is a tenant's best defense and a landlord's most reliable record. Never treat it as a minor piece of paperwork.

For Services and Deposits

When you're getting paid for a service, your receipt often has to do more than just show the final amount. This is especially true if you’re doing project-based work or require a deposit before you start.

If you’re writing a receipt for a deposit, the description should be unmistakable: "Deposit for Graphic Design Project - Project ID: GD125." Then, when you create the final receipt for the remaining balance, you’ll want to itemize everything you did, show the total project cost, and then clearly subtract the deposit they already paid.

Here’s how that might look:

- Item 1: Logo Design & Branding Package - $1,200

- Item 2: Social Media Graphics (5) - $300

- Subtotal: $1,500

- Less Deposit Paid (Receipt #045): -$500

- Total Amount Due: $1,000

This breakdown not only shows the full value of your work but also provides a transparent record of all payments. It’s a standard practice for a reason. You can find pre-built layouts for this and more by exploring different receipt templates designed for various business needs.

Moving from Pen and Paper to Digital Receipts

Are you still handwriting receipts on those flimsy carbon copy pads? Or maybe just tearing a page out of a notebook? It might feel fast at the moment, but we’ve all been there—faded ink, lost copies, and that dreaded shoebox overflowing with paper. It turns simple record-keeping into a real headache, wasting time and adding stress you just don’t need.

Making the switch to digital receipts is honestly one of the best moves any freelancer or small business owner can make. Instead of digging through a messy pile of paper, you get an organized, searchable, and professional archive of every single transaction. It’s a small change that makes your whole operation feel smoother and more modern.

The Clear Advantages of Going Digital

The payoff for ditching paper is immediate. Digital receipts aren't just about saving space; they make you look more professional and seriously clean up your financial tracking. Just imagine—no more panicked searches for that one missing receipt when tax season rolls around.

Digital receipts solve the most common frustrations of paper-based systems. They are instantly deliverable, impossible to lose when backed up, and provide a clean, professional record that reinforces customer trust.

And let's talk about security for a second. A digital file, especially one saved in the cloud, is worlds safer than a piece of paper that could get lost, damaged in a coffee spill, or just plain disappear. This approach keeps your financial records safe and sound, ready whenever you need them.

Embrace a Smarter Workflow

Businesses everywhere are moving away from paper, and the trend is only getting stronger. The digital receipts market is expected to jump from $2.1 billion in 2023 to $5.1 billion by 2033. That’s a huge signal of where things are headed. Right now, North America is leading the charge with a 36% market share, and simple email receipts are the most popular choice because they're so fast and easy. You can read the full research about digital receipt trends to see the data for yourself.

Here’s a look at the most common types of receipts you'll probably find yourself creating.

Whether you’re selling products, collecting rent, or getting paid for your services, a digital tool keeps everything consistent and accurate.

How to Create a Perfect Digital Receipt Instantly

The good news is that making the switch is incredibly simple. Using a tool like ReceiptMake, you can create a perfect digital receipt in no time, even if you’re not tech-savvy. It’s a great way to whip up everything from a quick gas receipt to a more formal donation receipt with just a few clicks.

Ready to try it? You can generate your own professional receipt right now. Here's all it takes:

- Pick a template. Find one that fits what you're doing.

- Fill in the details. Pop in your info, your customer's info, and what they paid for.

- Download and send. Grab the professional PDF and email it straight to your customer or print it out.

That’s it. This quick process gets rid of typos, saves you a ton of time, and makes sure every receipt you send out looks clean and professional.

A Few Pro Tips for Flawless Record-Keeping

Knowing how to write a receipt is just the first step. The real magic for your business's financial health happens after the ink is dry. Great record-keeping isn't just about being tidy; it's about building a rock-solid financial history that turns tax season from a chaotic scramble into a smooth, manageable process.

When you get this right, you're not just documenting payments. You're creating an unshakeable audit trail that gives you a crystal-clear picture of your business's health.

Keep Your Records the Right Way

So, how long do you actually need to hang onto all these receipts? It's a question I get asked all the time. While it can vary, a solid rule of thumb for most small businesses and freelancers is to keep all financial records for at least three to seven years. This window generally covers you for most tax audit scenarios.

Trust me, you don't want the headache of hunting down a crucial receipt from two years ago. The key is to have a system from the get-go. Whether that's a simple physical filing cabinet or a cloud storage folder, consistency is what will save you.

Once you've got your receipt creation down, the next step is keeping them organized. You can learn how to efficiently organize all your business receipts with a system that actually saves you time and stress. This transforms a messy pile of paper into a genuinely valuable business asset.

Note the Different Payment Methods

How you were paid matters, so your receipt should reflect that. The way money changes hands is evolving fast, which means our records need to be more precise than ever.

In 2022, global payments revenue saw double-digit growth, with electronic payments blowing past cash. With B2B transactions making up 69% of cross-border revenue, clear receipts are absolutely essential for tracking these digital money flows. You can find more insights on global payment trends at mcksinsey.com.

Here's a quick breakdown of how to handle common payment types:

- Cash: This is the one you need to document immediately. Why? Because there's no bank statement to back it up. A detailed receipt is your only proof. Using a dedicated cash payment receipt is a great way to make sure you don't miss anything.

- Credit/Debit Card: Always jot down the card type (like Visa or Amex) and the last four digits. This makes it so much easier to match the receipt to your payment processor statements later on.

- Digital Wallets (PayPal, Venmo): Be sure to include the transaction ID from the platform. That unique code is your best friend if you ever need to trace a specific payment.

Your record-keeping system is only as good as the information you put into it. Be specific about payment methods to create a clear audit trail that leaves no room for questions.

By treating every receipt as a vital piece of your financial puzzle, you ensure every dollar is accounted for. That's how you build a resilient, transparent business from the ground up.

Questions That Always Come Up About Receipts

Even after you get the hang of writing a receipt, you'll run into situations that make you pause. Getting these details right is key for keeping your books in order and making sure your customers feel confident in doing business with you.

Here are some of the most common questions I hear from freelancers and small business owners, along with straightforward, practical answers.

Do I Really Need to Write a Receipt for Every Single Sale?

Legally, it can depend on where you live and what you sell. But from a business perspective? Yes, absolutely. Think of it less as a legal burden and more as a professional habit.

Providing a receipt for every transaction is just smart business. It’s definitive proof of payment, which protects both you and your customer if any questions come up later. I always recommend giving a receipt, no matter how small the amount. It builds trust and ensures you have a perfect record for your own bookkeeping. No more forgotten sales or lost cash.

What's the Best Way to Number My Receipts?

The most important thing here is consistency. You just need a system that's logical and easy for you to follow, so you can pull up any specific transaction in a flash.

Most people use one of two simple methods:

- Simple Sequential: This is the easiest way to go. Just start with 001, then 002, 003, and keep going.

- Date-Based: This is great for organizing by month or year. A receipt might look like 2024-10-001 (the first receipt of October 2024).

This is one area where using a digital tool really shines. It handles the numbering for you automatically, so you never have to worry about skipping a number or accidentally creating a duplicate.

A good numbering system has one job: to make every transaction uniquely identifiable. Consistency is the key to creating an organized and searchable financial history for your business.

Can I Write a Receipt for a Cash Payment?

You not only can, but you absolutely should. A receipt for a cash payment is probably the most important one you can write. Why? Because there's no automatic digital trail from a bank or credit card company. The receipt you create becomes the only official proof that money changed hands.

The process is exactly the same as for any other payment type. Just fill out all the essential details we've covered. I also recommend adding a note like "Paid in Cash" in the payment method section for extra clarity. Using a dedicated cash receipt template makes this super simple.

How Do I Add a Signature Line to a Receipt?

Adding a line for a signature is a great move, especially if you're providing a service or selling high-value items. It serves as confirmation from the customer that they received the goods or were satisfied with the completed work.

If you're making one from scratch, just add a line at the bottom with text like "Customer Signature" or "Received By," leaving space for them to sign and date. Many templates built for services, like our contractor receipt or restaurant bill, already have this feature included. It’s a simple way to add an extra layer of security to your transactions.

Creating professional, accurate receipts doesn't have to be a chore. With the right tools, it's incredibly simple. ReceiptMake lets you generate a perfect receipt in seconds with dozens of templates designed for just about any situation you can think of.