How to Prepare for Tax Season A Stress-Free Guide

Let's be honest, tax season is something most of us dread. It feels like a mad dash to the finish line, but it doesn’t have to be. The real secret isn't about being a numbers wizard; it's about shifting your mindset. Think of tax prep as a year-round habit, not a last-minute panic. When you organize your financial documents and track expenses as you go, what was once a stressful chore becomes a powerful way to review your business's financial health.

Why Early Tax Prep Is Your Secret Financial Weapon

For small business owners and freelancers, the mere mention of taxes can cause a spike in anxiety. We've all been there staring at a shoebox full of crumpled receipts, trying to make sense of a year's worth of transactions. But starting early changes the entire game. It’s less about just meeting a deadline and more about taking control of your finances.

I once worked with a café owner who started organizing his receipts every quarter instead of waiting until April. Just by doing that, he found an extra $2,000 in legitimate deductions for things like specialty coffee supplies and last-minute social media ads. That’s real money back in his pocket, all because he wasn't rushing. When you're in a hurry, you almost always leave money on the table.

The True Cost of Procrastination

Putting off your taxes until the eleventh hour forces you into a defensive position. You’re far more likely to make simple mistakes, misplace a crucial bank statement, or completely forget about deductions that could save you a significant amount of cash. These slip-ups don't just hit your wallet; they can also attract unwanted attention from the IRS and increase your audit risk.

It's easy to get lost in the sheer volume of paperwork. The IRS processed over 163 million individual returns in a recent season, with tax professionals preparing more than 86 million of them. Getting ahead of the curve ensures your records are clean, accurate, and ready to go, which means fewer errors that could delay a refund or trigger a review.

Think of it this way: Proactive tax prep is really a strategic review of your business. It shines a light on your cash flow, helps you spot savings, and gives you the insight to make better financial decisions all year long.

Turning Preparation Into a Strategic Advantage

Making tax prep a regular habit pays off in ways that go well beyond filing day. It provides a clear, ongoing picture of your business's financial health, which is invaluable for smart budgeting and future planning.

Here’s how an early start gives you a serious leg up:

Find More Deductions: When you aren't rushed, you can go through every single expense with a fine-tooth comb. What about that software subscription you forgot? Or that dinner with a potential client? Early prep helps you catch everything.

Avoid Costly Mistakes: Rushing is a recipe for typos and calculation errors. Preparing your documents ahead of time allows for a thorough review, which means better accuracy and a lower chance of facing penalties.

Make Smarter Financial Plans: Having a solid grasp of your tax liability helps you budget for quarterly estimated payments and make more informed decisions about where your business is headed next year.

This approach is about turning a requirement into an opportunity. By putting the right systems in place now, you can walk into tax season feeling confident and in control, not stressed and scrambling.

Your Complete Tax Document Checklist

A smooth tax season always starts with getting your paperwork in order. When it comes to the IRS, guesswork simply won’t cut it; you need solid proof for every single number on your return. Let’s walk through the essential documents you’ll need to pull together, focusing on what really matters for freelancers and small business owners.

Think of it this way: gathering these documents is about more than just checking a box for compliance. You're building the financial story of your business's year. A well-documented story allows you to claim every deduction you've rightfully earned. A little organization now will save you a ton of stress later and could put more money back in your pocket.

Your Tax Document Preparation Checklist

Before we dive into the details, here's a quick-glance checklist of the essential documents you'll need. Having these ready will make the entire process much smoother.

| Document Category | Specific Documents to Gather | Why It's Important |

|---|---|---|

| Identity & Income | Social Security or ITIN Card, Forms 1099-NEC, 1099-K, W-2s | These forms verify your identity and show the income that clients and payment processors have already reported to the IRS. |

| Financial Statements | Business Bank and Credit Card Statements (all 12 months) | Provides a complete, chronological record of every dollar in and out, serving as the backbone for your bookkeeping. |

| Expense Proof | Categorized Receipts, Invoices, Bills (for supplies, software, rent, utilities, etc.) | This is your proof for deductions. No receipt, no deduction. It's that simple. |

| Asset Information | Purchase Records for Major Equipment, Vehicles, or Property | Needed to calculate depreciation, a significant deduction for many businesses. |

| Payroll & Payments | Payroll Summaries, Records of Estimated Tax Payments | If you have employees, payroll docs are non-negotiable. Proof of your own estimated payments prevents underpayment penalties. |

| Previous Filings | Last Year's Federal and State Tax Returns | Incredibly useful as a reference point for consistency and to ensure you haven't missed anything. |

Having these items organized and ready to go is half the battle. Now, let's break down why each of these is so crucial.

Core Income and Identity Documents

First things first, let's get the foundational paperwork out of the way. These documents are the absolute basics that verify who you are and what income has been reported to the IRS on your behalf.

You really can't even start the filing process without these.

Social Security Number (SSN) or ITIN: This is your main identifier with the IRS.

Income Forms (1099-NEC, W-2, etc.): As a freelancer, you’ll get a Form 1099-NEC from any client who paid you $600 or more. If you also have a day job, you'll have a W-2 from that employer.

Last Year's Tax Return: I always recommend keeping the previous year's return handy. It’s an invaluable reference for making sure your numbers are consistent and you haven’t forgotten anything.

Essential Business Financial Records

This is where your diligence as a business owner really pays off. These records paint the complete financial picture of your business and form the backbone of your tax return. In the event of an audit, strong records are your absolute best defense.

Your bank and credit card statements are ground zero. They give you a month-by-month log of all your income and spending, which you'll use to cross-reference and verify every transaction.

If you have employees, your payroll records are just as important. You’ll need a summary of all wages paid, payroll taxes you withheld, and any unemployment tax payments. And don't forget about your own estimated tax payments. Those quarterly payments are essential for avoiding nasty underpayment penalties, and you need to have proof of when and how much you paid.

Key Takeaway: Your business's financial story isn't just told through 1099s. It's built from a combination of bank statements, payment records, and, most importantly, detailed proof of every single expense.

The Power of Organized Expense Receipts

I can’t stress this enough: this is where most small businesses leave thousands of dollars on the table. Every legitimate business expense lowers your taxable income, but you can only deduct what you can prove. A line on your credit card statement is a start, but a detailed receipt is what proves what you bought and why it was a business expense.

Imagine you paid a local vendor in cash for materials and walked out without a receipt. In the eyes of the IRS, that expense might as well have never happened. It's such a common mistake, and it can be a very costly one.

But what do you do when a receipt is genuinely lost, or you were never given one? This is where you can reconstruct the record. Tools like ReceiptMake are built for exactly these moments. If you’re missing a record for a cash payment, you can instantly use a professional template to create a clean, audit-proof document. Whether you need a simple cash receipt template or something more detailed, you can fill in the date, item description, and amount to generate a valid record. This simple step can turn a frustrating documentation gap into a fully supported deduction, making sure you get every penny you deserve.

Mastering Your Books With Year-Round Habits

Great bookkeeping isn't something you can cram into a few frantic weeks before the tax deadline. It's really a series of small, consistent habits that pay off big time when you're ready to file. This approach turns tax prep from a nightmare of chasing down old paperwork into a simple, routine financial check-up.

When you treat your books as a year-long priority, you get a real-time, accurate picture of your business's financial health. It’s the difference between getting one annual physical versus regularly monitoring your health; one gives you a single snapshot, while the other helps you make smart decisions every single day.

The Power of Monthly Reconciliation

At the core of good bookkeeping is reconciliation. It’s the simple act of matching your bank and credit card statements against your own financial records. Think of it as balancing a checkbook, but for your whole business. This monthly habit is your absolute best defense against costly mistakes.

When you reconcile regularly, you immediately spot things like duplicate vendor charges, a missed client payment, or even potential fraud. Catching a $50 billing error in February is easy. Trying to find it a year later, buried in twelve months of statements? That’s a headache you don’t need.

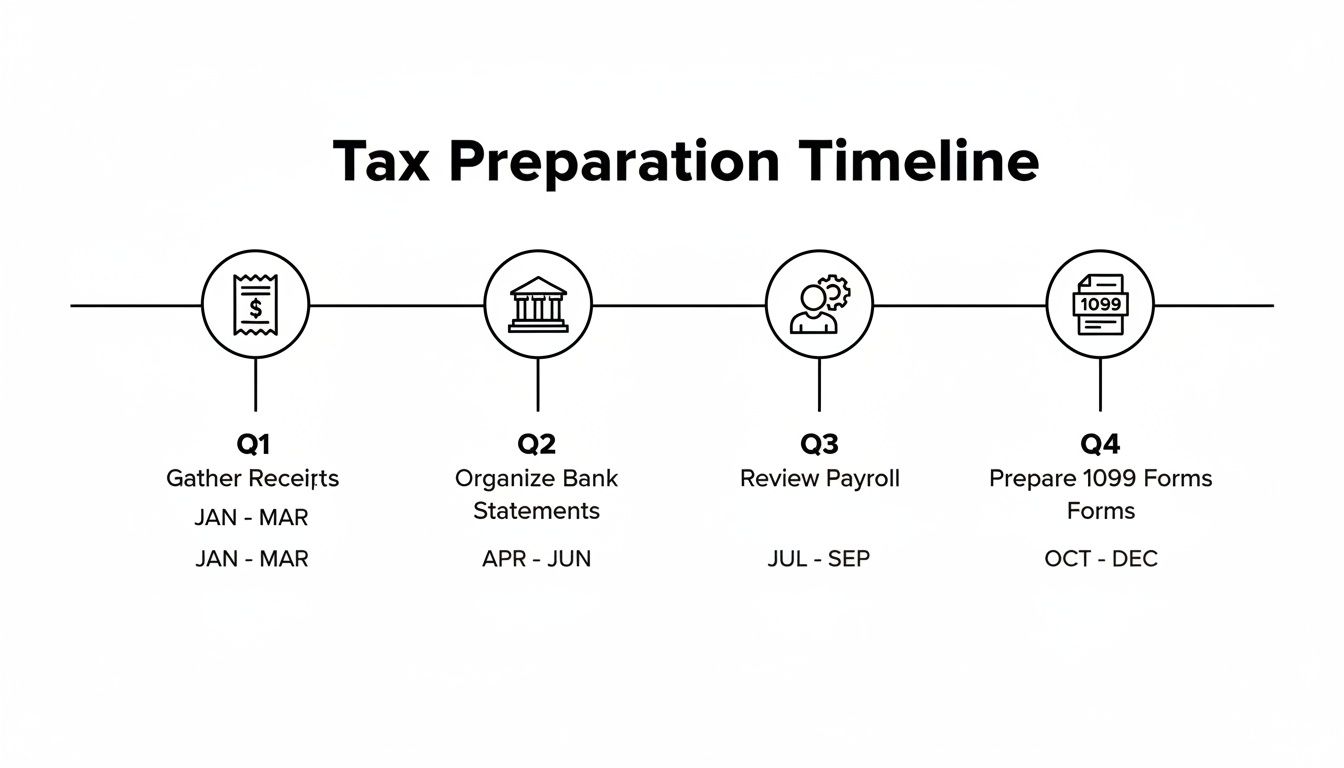

This infographic breaks down key tasks to focus on each quarter, showing how a little consistent effort makes tax season totally manageable.

As you can see, spreading out tasks like receipt management and payroll review prevents a massive pile-up in the final months.

Separate Business from Personal

One of the biggest and most damaging mistakes I see freelancers and small business owners make is mixing their personal and business finances. Using your business debit card for groceries or paying a vendor from your personal checking account creates a tangled mess that’s incredibly hard to unravel later.

This practice, known as "co-mingling funds," doesn't just make bookkeeping a nightmare; it can put you at serious risk in an audit by blurring the lines on what counts as a legitimate business expense. The solution is simple, but you have to stick to it:

Open a dedicated business bank account. Every dollar of business income goes in here.

Get a separate business credit or debit card. Use this card only for business purchases.

Pay yourself a salary. Formally transfer money from your business account to your personal one as an owner's draw or salary.

By creating this clear separation, you're establishing a professional financial boundary. This doesn't just make tax prep easier; it reinforces the legitimacy of your business in the eyes of the IRS.

Make Record-Keeping an Instant Habit

The last piece of the puzzle is to log every single business expense the moment it happens. Waiting until the end of the month or worse, the end of the year is a surefire way to lose receipts and forget about valuable deductions.

Picture this: you just finished a week-long business trip with a handful of small cash receipts for tolls, coffee with a client, and parking. Instead of letting them get lost in your wallet, you can take five minutes to create clean, digital records for each one. That quick action ensures nothing falls through the cracks.

For those times when a receipt gets lost or you make a cash purchase and don't get one, it's critical to reconstruct that record right away. You can generate professional receipts instantly using templates for things like travel, meals, or supplies. Capturing the date, amount, and business purpose while it's all fresh in your mind makes your next reconciliation a breeze and keeps your records audit-proof. This habit alone can save you hundreds, if not thousands, in missed deductions.

Finding Every Business Deduction You Deserve

Deductions are your best friend at tax time. They lower your taxable income, which means you get to keep more of your hard-earned money right where it belongs in your business. But here’s the golden rule every freelancer and small business owner needs to live by: you can only claim what you can properly document.

This is where knowing the rules and keeping meticulous records becomes your biggest financial advantage. Let's dig into some of the most common and often missed deductions that can make a huge difference in your final tax bill.

Unlocking Your Home Office Deduction

Do you have a dedicated space in your home that you use exclusively for your business? If so, you can likely claim the home office deduction. This is a powerful way to write off a portion of your household expenses, including rent, mortgage interest, utilities, and your internet bill.

You've got two ways to calculate this:

The Simplified Method: This is the no-fuss option. You can deduct $5 per square foot of your home office, capped at 300 square feet for a maximum deduction of $1,500. It’s incredibly straightforward and doesn't require a mountain of paperwork.

The Regular Method: This approach requires more work but can lead to a much bigger deduction. You'll calculate the percentage of your home used for business and apply that percentage to your actual home-related expenses. It's a great choice if you have a large workspace or high household costs.

Run the numbers for both. Just be ready to back up whichever method you choose with solid records of your expenses and proof that your workspace is truly dedicated to your business.

Tracking Vehicle and Travel Expenses

For a lot of us, the road is our office. If you use your personal vehicle for business driving to client meetings, picking up supplies, or making deliveries, those miles are money in your pocket.

Like the home office deduction, you have two options for claiming this expense:

Standard Mileage Rate: This is the easiest route. The IRS sets a specific rate per mile each year. All you have to do is track your business miles and multiply that number by the current rate. Simple.

Actual Expense Method: This involves tracking and deducting the real costs of using your car. You’ll add up everything gas, oil changes, insurance, repairs, and then multiply the total by the percentage of time you used the car for business.

Business travel is another huge source of deductions. Think flights, hotels, and 50% of your meals while you're on the road for work. The key, as always, is documentation. If you attend a conference in another city, you need pristine records of your travel and lodging. Creating a detailed record with something like a hotel receipt template is perfect for capturing the dates, location, and costs, giving you solid proof for your travel deduction.

Software, Subscriptions, and Supplies

In today's world, the recurring costs for software and subscriptions add up fast. The good news? They are almost always fully deductible.

Just think about all the tools you pay for to keep your business running:

Accounting software like QuickBooks or Xero

Project management tools like Asana or Trello

Social media scheduling platforms

Website hosting and domain fees

Industry-specific software subscriptions

And don't forget the everyday stuff. Printer paper, pens, even the coffee you buy for the office, it's all deductible. Keep every single receipt, because these small purchases can turn into a significant write-off over the course of a year. If you want to get a handle on this, learning about effective business expense tracking is a fantastic use of your time.

Pro Tip: Don't forget about investing in yourself. The cost of courses, workshops, industry conferences, and even books that help you get better at what you do are all legitimate business expenses.

Documenting Meals and Entertainment

The rules around meals and entertainment can feel a bit tricky, but they're a common and legitimate business expense. As a general rule, you can deduct 50% of the cost of a meal with a client or business associate, as long as the purpose was to talk business.

This is one area where the IRS gets particularly strict about documentation. A simple credit card statement showing a charge at a restaurant won't cut it. For every meal, you need to record:

The date and location.

The total cost.

The business purpose of the meeting.

The names of everyone who attended.

Lost a receipt from a client lunch? Don't just write off the deduction. A tool like ReceiptMake lets you generate a new record with a restaurant receipt template, ensuring you include all the necessary details to create an audit-proof document.

Tax season is no joke. One recent year, the IRS received 163,594,000 returns by mid-October a 1.3% jump from the year before. With tax pros handling over 86 million of those, having organized records for every single deduction is what will make your filing experience a smooth one.

DIY vs. Hiring a Pro: Which Filing Strategy is Right for You?

Alright, you've wrangled your documents and everything is in order. Now you're at a fork in the road: do you file your taxes yourself, or do you call in a professional?

There's no one-size-fits-all answer here. The right choice really hinges on your business's complexity, how comfortable you are with tax forms, and what your time is worth. It's a classic trade-off between cost and expertise. While today's tax software makes DIY filing easier than ever, the peace of mind an expert provides can be worth its weight in gold, especially as your business scales.

The Case for DIY Tax Software

Going it alone can be a great, budget-friendly move if your business finances are pretty straightforward. If you're a solo freelancer with one main income source and you're taking standard deductions, tax software can walk you through the whole process without much fuss.

Here are a couple of scenarios where DIY is a solid choice:

You're a Freelance Writer: You've got a handful of 1099-NEC forms, some home office and software expenses to track, and no employees. Most software uses a simple Q&A format that can handle this setup easily.

You Run a Small Online Shop: All your income flows through one platform like Etsy, and your expenses are mostly materials and shipping. It’s pretty simple to categorize and plug those numbers in.

The biggest win here is obviously the cost savings. You sidestep professional fees and get a much better feel for your own financial picture. The catch? You have to be meticulous and ready to put in the time to do it correctly.

When to Call in a Tax Professional

As your business grows, your finances get more complicated. This is when hiring a Certified Public Accountant (CPA) or another qualified tax pro stops being an expense and starts becoming a smart investment.

You should seriously think about hiring an expert if you:

Run a retail shop with physical inventory and a payroll.

Are set up as an S Corp or partnership, which comes with its own complex filing rules.

Have major assets, investments, or earn income in multiple states.

Frankly, just don't have the time or confidence to go it alone.

A good tax pro does way more than just fill out forms. They provide strategic advice that can lower your tax bill all year long. They'll spot deductions you didn't know existed and make sure you're staying on the right side of constantly changing tax laws.

Tax rules are getting more complex worldwide, it's not just you. A recent Deloitte survey found that 100% of over 1,100 tax executives see the digitalization of tax as a major factor. While millions of people file their own returns just fine, tax codes are evolving in nearly 150 territories. Professional guidance is often the key to navigating these changes and avoiding audit red flags. You can check out more from this global tax survey at Deloitte.com.

Ultimately, whichever path you take, your prep work is what makes the difference. If you hand your tax pro a perfectly organized digital folder, you're saving them time and that saves you money.

Having all your records ready to go, including receipts you’ve created for cash payments using a general purpose receipt or a generic sales receipt, makes their job smoother and your return more accurate. By getting organized first, you set yourself (and your expert) up for a successful, stress-free filing.

Got a Few Lingering Tax Questions?

Even with a solid plan, a few tricky questions always seem to pop up during tax season. You’re not the first freelancer or small business owner to get stuck on the details, and you certainly won’t be the last. Getting these common sticking points sorted out is the final piece of the puzzle.

Let’s clear up some of the questions I hear most often.

What’s the Single Best Thing I Can Do to Prepare for Tax Season?

Honestly? The most important thing you can do is keep your financial records organized all year long not just in a mad dash before the filing deadline. This means diligently tracking every dollar that comes in and, just as importantly, every single business expense as it happens.

Nine times out of ten, messy records are why small businesses miss out on deductions they’re entitled to. Get into the habit of creating a digital record for every transaction right away. This simple, consistent routine can turn tax season from a chaotic mess into a straightforward review of your year's finances.

This habit becomes a real lifesaver for those little cash expenses or when you inevitably misplace a piece of paper. You can use a tool like ReceiptMake to generate a professional, detailed receipt on the spot with a general business template, making sure no legitimate expense gets left behind.

How Long Do I Really Need to Keep My Business Receipts?

This one trips a lot of people up, and the answer is probably longer than you think. The IRS officially says you need to keep your tax records for a minimum of three years from the date you filed your return.

However, if you ask any seasoned tax pro, they’ll tell you to hang onto everything for seven years. Why the difference? The three-year rule has a few exceptions, like if you accidentally underreport your income by a significant amount. The seven-year mark is the safest bet, hands down.

The easiest way to manage this is by going digital. After you create a record for an expense, save the PDF to a cloud service like Google Drive or Dropbox in a folder labeled by year. It keeps your records secure, searchable, and ready to go if you ever get a notice from the IRS.

Think of it this way: an organized digital archive is your best defense. It saves a ton of physical space and gives you peace of mind, knowing your proof is just a few clicks away if you ever need it.

Is It Okay to Create a Receipt If I Lost the Original?

Yes, absolutely. You can and should create a new record for a legitimate business expense if the original receipt is gone or was never given to you in the first place. This isn't some shady workaround; it's a common and accepted practice. In fact, the IRS "Cohan Rule" allows you to prove an expense with other credible evidence, and a well-made, reconstructed receipt is a key part of that.

Using a tool designed for this is your best bet, as you can build a document that accurately reflects the original transaction.

For example, let's say you bought a bunch of supplies from a vendor at a weekend market who was cash-only and didn't have a receipt book. Instead of just losing out on that deduction, you could use a retail sales template to create a new record. Just plug in the correct date, an itemized list of your purchases, and the total you paid. When you pair that new receipt with the matching cash withdrawal from your bank statement, you've built a solid case for your deduction.

This simple step ensures you can claim every single expense you're entitled to. The same goes for services, if you paid a contractor, you can generate a professional service receipt to document the payment properly.

What if I Can't Pay My Taxes by the Deadline?

First off, don't panic. The absolute most important thing to do is file your tax return on time, even if you can’t pay a dime of what you owe. The penalty for failing to file is almost always much harsher than the penalty for failing to pay.

After you've filed, you have a few paths forward:

Short-Term Payment Plan: The IRS can give you up to 180 extra days to pay your bill in full. Just know that interest and penalties will continue to add up.

Offer in Compromise (OIC): This is for people in tough financial spots. An OIC lets you resolve your tax debt with the IRS for less than the full amount you originally owed.

Installment Agreement: If you need more than 180 days, you can apply for a long-term payment plan and pay your bill in monthly installments.

The IRS is surprisingly willing to work with you if you're proactive and communicate with them. The worst thing you can do is ignore the problem. Face it head-on, and you'll find a solution.

Ready to get your expense tracking under control? With ReceiptMake, you can generate clean, accurate receipts for any business transaction in just a few seconds. Pick from over 100 templates, fill in your details, and download a perfect PDF every time. Start creating your free receipts today at https://receiptmake.com.