How to Make a Receipt for Payment That Works

Creating a receipt for payment is pretty simple once you get the hang of it. You just need to document the transaction by listing a few key things: your business information, the customer's name, a clear list of the goods or services provided, the total amount they paid, and the date.

Using a template or a receipt generator is a great way to make sure you don't miss anything and that it looks professional every single time.

Why a Professional Receipt Is a Business Essential

Figuring out how to create a solid receipt is so much more than a bookkeeping chore. Think of it as a core part of running your business well. A professionally crafted receipt is often the last interaction you have with a client, and it can really cement their confidence in your work, leaving a great final impression. It's also the official, undeniable proof of a finished transaction, which protects both you and your customer.

Building Trust and Heading Off Disputes

A clear, itemized receipt leaves zero room for guesswork. When your customers can see exactly what they paid for—right down to the specific services, products, and any taxes—it cuts off potential confusion or disputes before they can even start.

This kind of transparency is a huge part of building and keeping strong client relationships. It sends a clear signal that your business is organized, honest, and professional, which is exactly what makes people want to come back.

Think of a receipt as the closing argument for a successful transaction. It summarizes the agreement, confirms the value delivered, and provides a concrete record that prevents misunderstandings long after the payment is made.

Simplifying Your Financial Records

Every business owner, freelancer, and contractor knows that organized financial records are non-negotiable, especially when tax season rolls around. Professional receipts are the foundation of good bookkeeping. They give you the proof you need to track your income, verify expenses, and back up your tax filings if you ever face an audit.

This has become even more important as digital payments have taken over. Issuing proper receipts is a practice that goes way back to ancient trade, but it's become a formalized part of modern business. With the global payment processing market expected to hit somewhere between $60–$140 billion by 2025, the need for verifiable transaction records has never been greater. You can dive deeper into the payment processing market's growth on ClearlyPayments.com.

Having a consistent system for creating and storing receipts keeps your financial data tidy and easy to find. This doesn't just make your own accounting easier; it also makes working with a bookkeeper or accountant a breeze, ultimately saving you a lot of time and money. Getting this simple document right is a key step toward financial clarity and a smoothly running business.

What Goes Into a Perfect Receipt?

Think of a receipt as more than just proof of payment. It's a key piece of communication between you and your customer, a legal document, and a vital tool for your own bookkeeping. When you get the details right, it builds trust and makes your business look sharp. Let's break down exactly what components make a receipt professional and effective.

First up, your business information needs to be front and center. This isn't the place for subtlety. Your business name, address, phone number, and email should be clearly displayed at the top. It instantly answers "Who is this from?" and gives your customer an easy way to get in touch if they have questions.

Next, you'll want to include your customer's details. Adding the customer’s name and maybe their address does more than just personalize the document; it creates a solid record of who paid for what. This is absolutely critical for service providers or anyone selling high-ticket items where you need to connect a specific payment to a specific client file.

Nailing Down the Transaction Details

Every single receipt you issue needs its own unique ID. This is where a sequential receipt number is your best friend. It’s like a tracking number for each transaction. By simply following a sequence like 001, 002, 003, you make it incredibly easy to find any sale later on. Trust me, you'll thank yourself when it's time to do your books or a customer calls about a payment from six months ago.

The transaction date is another absolute must-have. It pins down the exact moment the payment was made. A quick pro-tip: if you work with international clients, use an unambiguous format like 25-OCT-2024 to avoid any mix-ups between US (MM/DD/YYYY) and European (DD/MM/YYYY) date styles.

A well-structured receipt doesn't just list numbers; it tells the complete story of the transaction. From the unique receipt number to the final total, each piece of information works together to create an unambiguous, professional record that protects both you and your client.

Now for the heart of the receipt: the itemized list. This is where clarity is king.

- Be Specific: Don't just write "Consulting." Instead, specify "Social Media Strategy Consulting (5 hours)." Vague descriptions lead to confused customers.

- Show Your Work: Always include the quantity and the price per unit. This transparency helps customers see exactly how you arrived at the final cost.

- Add Line Totals: For each item, multiply the quantity by the unit price and put the total for that line.

Getting this level of detail right from the start can prevent a lot of questions and potential disputes down the road.

Wrapping Up the Financials

Once everything is itemized, you need to present a clean, easy-to-read financial summary at the bottom.

Start with the subtotal—the total cost of all items before any taxes or discounts. Then, on a separate line, add any sales tax or other required taxes. If you’ve given the customer a discount, show that clearly as a deduction.

Finally, the grand total should be big and bold. This is the final amount they paid, the most important number on the page. It's also great practice to note the payment method used (e.g., Credit Card, PayPal, Cash). This is a huge help when you're reconciling your bank accounts later.

Putting all of this together from scratch every time you make a sale would be a huge pain. To make sure you’re consistent and professional without the administrative headache, checking out some pre-built receipt templates can be a real game-changer. It frees you up to focus on what you actually do best.

Choosing the Right Tool to Create Your Receipts

How you make a receipt for payment says a lot about your business. The right tool can make you look professional and save you precious time, while the wrong one just creates administrative headaches. Honestly, the best fit really comes down to where your business is at—your transaction volume, your budget, and how much time you want to spend on paperwork.

For a lot of people just starting out, a simple digital template is the obvious first choice. Firing up a pre-made document in Microsoft Word or a Google Sheet is free and doesn't require any special software. You just plug in the details, save it as a PDF, and email it over. This works perfectly fine when you're dealing with a handful of clients, but it can get messy fast as you grow. Trust me, manually tracking receipt numbers and keeping all those files organized becomes a real chore.

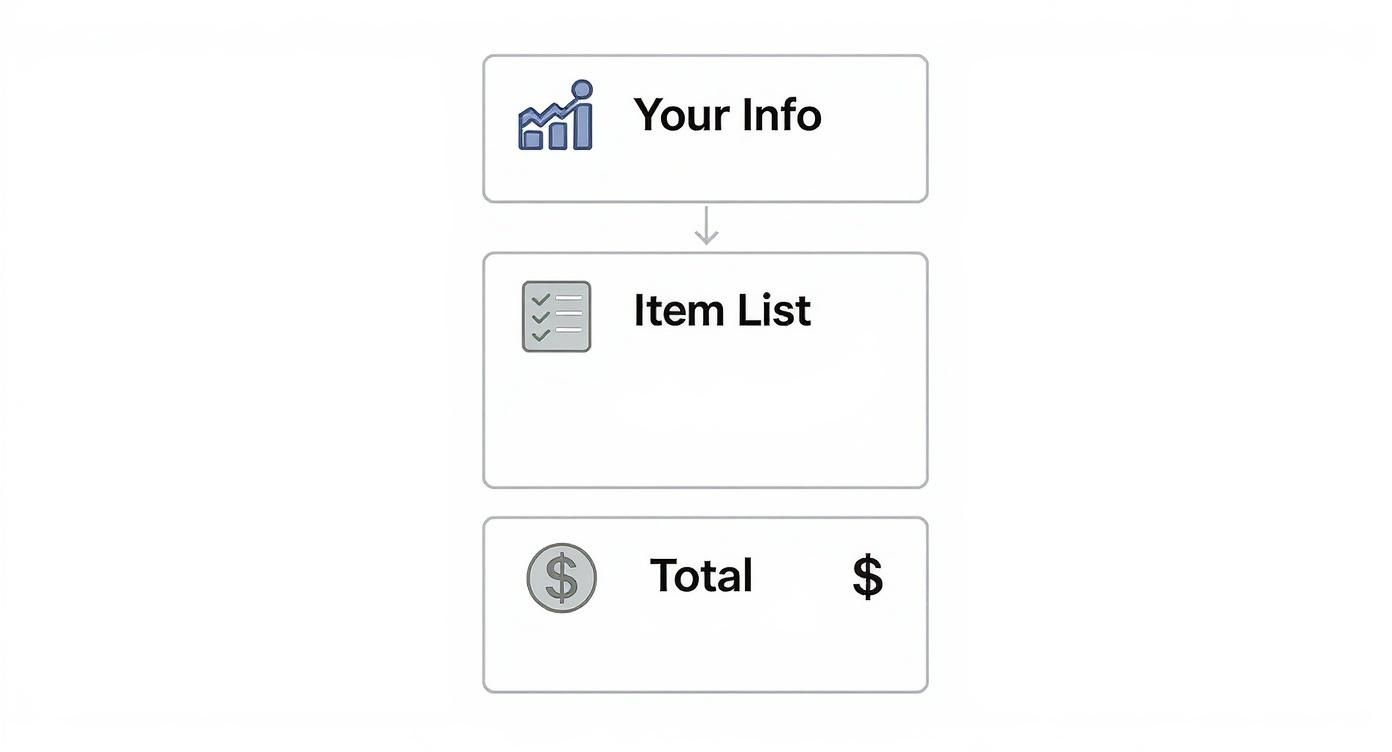

No matter which tool you land on, the fundamental structure of a good receipt stays the same. This visual breaks it down nicely.

As you can see, splitting your receipt into three distinct parts—your info, the itemized list, and the totals—makes it instantly professional and easy for your customer to understand.

Upgrading to Dedicated Software

When you feel like you're spending more time managing templates than running your business, it's time to look at dedicated software. This is the next logical step. Tools like Wave or Zoho Invoice are a huge upgrade from manual methods.

These platforms are built to handle the tedious stuff for you:

- Automatic Numbering: They assign a unique, sequential number to every single receipt, which gets rid of manual tracking and the risk of human error.

- Customer Management: You can save a client's information once and have it auto-populate every future receipt. It's a small thing that saves a ton of time.

- Financial Reporting: Most of these tools can spit out reports on your sales, taxes collected, and outstanding payments, giving you a much clearer picture of your finances.

Of course, the trade-off is usually the cost, as many of these services run on a subscription. But the time you get back and the professional polish they add often make it a worthwhile investment.

The Rise of Digital and Custom Solutions

The massive shift to digital payments has really forced businesses to get smarter about how they issue receipts. Think about it: in 2023, digital wallets were used in about 52% of all e-commerce transactions in North America. Meanwhile, the UK's Faster Payments system handled a staggering 4.4 billion transactions. You can read more about these global payment trends on Planergy.com. Numbers like that simply demand automated and accurate receipting.

Deciding on a receipt creation method is a balance between your current needs and future growth. The table below breaks down the common options to help you see where you might fit.

Receipt Creation Method Comparison

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Templates | Freelancers, startups, and low-volume businesses. | Free, easy to start, and requires no special software. | Time-consuming, prone to manual errors, hard to scale. |

| Dedicated Software | Growing small to medium-sized businesses. | Automates numbering, saves customer data, offers reporting. | Often has a monthly subscription cost, slight learning curve. |

| Custom-Built | Large businesses or those with unique workflows. | Complete control, integrates perfectly with other systems. | Very expensive, requires development resources, complex to build. |

Ultimately, whether you stick with a simple template or go for a full-featured software, the goal is to find a system that works for you without causing more stress.

For businesses with truly unique workflows or a very high volume of transactions, a completely custom-built solution might be the end goal. It's the most expensive and complicated route, for sure, but it gives you total control over every feature, integration, and branding element.

If you're looking for a great middle ground that's professional but still incredibly fast, you can always use a free tool to generate a professional receipt in seconds. It's a good way to see just how much smoother the process can be.

Adding Professional Touches That Build Client Trust

With all the essential data plugged in, it's time to transform your receipt from a simple proof of payment into something more. Think of it as the final handshake in your transaction. A few thoughtful details can go a long way in making a customer feel good about their purchase and reinforcing their trust in you.

The easiest win? Your company logo. Placing your logo right at the top instantly makes the receipt look official and reinforces your brand. It takes a generic piece of paper and makes it yours, adding a layer of legitimacy that customers absolutely notice.

Going Beyond the Basics

A little personality can make a big difference. Something as simple as "Thank you for your business!" or "We appreciate you!" at the bottom adds a warm, human touch. It’s a simple gesture that ends the transaction on a high note and helps build the kind of goodwill that brings people back.

For certain types of sales, adding a signature line is a smart, protective measure.

- High-Value Services: If you're a consultant, web designer, or contractor, a signature line confirms both parties agree the work was completed and paid for. It's an extra layer of security for everyone involved.

- Physical Goods: When you're delivering an expensive item, getting a signature is proof that the customer received it in good condition. This can be a lifesaver if a dispute comes up later.

A receipt isn't just for your accountant; it's the last piece of the customer experience puzzle. Small details like your logo, a thank-you note, and clear terms can turn a basic transaction into a chance to show you’re transparent and committed to good service.

Setting Clear Expectations

Finally, use the space on your receipt to get ahead of potential questions. Briefly stating your return policy, warranty info, or key terms of service can prevent a lot of headaches down the road. It shows you're upfront and gives the customer everything they need in one place.

For instance, a simple line like, "Returns accepted within 30 days with this receipt," makes your policy crystal clear. This kind of foresight shows you run a tight ship and puts your customer's mind at ease. You can see great examples of how these elements fit together on templates like this Generic POS Receipt.

Navigating Legal and Tax Requirements

Getting your receipts right is about more than just looking professional—it's a critical part of keeping your business financially and legally safe. When you issue a receipt for payment, you're not just closing a sale. You're creating an official document that becomes your go-to proof during a tax audit.

Think of it as your paper trail. Without that trail, you’re inviting questions from tax agencies and leaving yourself in a tough spot. A solid collection of receipts shows you’re running a transparent, legitimate business, which is exactly the impression you want to give.

Understanding Record-Keeping Rules

Most places have strict rules about how long you need to hang onto your financial records. The exact timeline can vary, but a good rule of thumb is to plan for three to seven years. Tucking your receipts away for this long isn't optional; it's a must.

And this isn't just about appeasing the tax authorities. Receipts are also your customer's lifeline for consumer protection. They're the official proof of purchase someone needs for a return, a warranty claim, or a rebate. So, by providing a detailed receipt, you're not just covering your own bases—you're fulfilling your legal responsibility to your customer.

Think of each receipt as an insurance policy for a transaction. It protects you from potential tax scrutiny, shields you from legal disputes, and gives your customers the documentation they need, reinforcing their trust in your business.

This need for clear documentation is only getting more important. Between 2019 and 2024, global payments revenue grew by an average of 7% each year. This boom has been shaped by regulations like the EU's PSD2 framework, which requires more transparency in how transactions are reported—a job receipts are made for. As e-commerce continues to grow into the trillions, compliant receipts are vital for spotting fraud and meeting anti-money laundering rules. You can dig into more of these payment industry statistics and trends on gr4vy.com.

Receipts and Your Tax Obligations

Let’s talk taxes. Your receipts are directly tied to how you report your income. In the U.S., for instance, the IRS is paying much closer attention to payments that come through platforms like PayPal or Stripe. The reporting threshold for getting a Form 1099-K, which documents these payments, is dropping fast.

For 2024, that threshold fell to just $5,000. That means a lot more small businesses and freelancers are going to get these forms, and the IRS will expect you to have the records to match those figures.

Here’s why your receipts are absolutely essential when that happens:

- Proof of Income: Your pile of receipts needs to add up to the gross income reported on your 1099-K. No discrepancies.

- Justification for Deductions: The 1099-K only shows the money that came in, not what went out. Your receipts for business expenses—like supplies, software, or travel—are the only way you can prove your deductions and lower your taxable income.

If you don't have accurate receipts, you could easily end up overpaying on your taxes or, worse, facing penalties in an audit. Getting a handle on these rules isn't just about staying compliant; it's about protecting your hard-earned money from fines and legal stress.

Got Questions About Making Receipts? Let's Clear Things Up.

Even when you think you've got the process down, a few questions always seem to come up when you're making receipts. It's totally normal. Getting these sorted out will help you handle any transaction like a pro.

Let's walk through some of the most common head-scratchers I hear from business owners.

Invoice vs. Receipt: What’s the Real Difference?

This one trips people up all the time. An invoice and a receipt can look almost identical, but they play completely different roles in a sale. Think of it this way:

- An invoice is the ask. It's what you send a client before they pay you, spelling out exactly what they owe for your work or products.

- A receipt is the confirmation. You give this to them after the money has hit your account, proving the deal is done and paid for.

So, an invoice kicks things off, and a receipt wraps it all up. You really can't swap one for the other if you want to keep your financial communication clean and professional.

Can I Just Scribble a Receipt on Paper?

You sure can. A handwritten receipt is totally legitimate, as long as it has all the essential info we talked about earlier. Just make sure you include your business details, the customer's name, the date, a good description of what they bought, the total paid, and how they paid.

But here’s my two cents: while a handwritten note is fine in a pinch, digital receipts are a much better look. They appear more polished, are way easier to keep track of for your own bookkeeping, and you can send and save them instantly. For a smooth and professional operation, going digital is almost always the smarter move.

Do I Really Need a Receipt for Every Little Thing?

While the specific laws can change depending on where you are and what you sell, I always tell people to get in the habit of issuing a receipt for every single sale. Yes, even the small ones.

Why? It creates a paper trail that protects both you and your customer. If a dispute ever comes up, that receipt is your best friend.

More than that, it's a must for solid bookkeeping. Having a complete set of receipts means your income records are bulletproof, which is absolutely critical come tax time. Using a simple digital tool can make this an automatic, thoughtless part of your process.

A receipt isn't just a courtesy; it's a core business document. It's undeniable proof of a transaction, protects everyone involved, and is the bedrock of your financial records and tax filings.

Whoops, I Made a Mistake on a Receipt. Now What?

It happens to the best of us. If you've already sent out a receipt with a goof on it, the right way to fix it is to void the original receipt and then issue a brand new, corrected one. This is non-negotiable for keeping your books straight.

First, go into your system and clearly mark the original receipt as "VOID." This tells your software (and your future self) not to count it as income. Then, create a new receipt with all the right information and a fresh receipt number. Send that new one over to your customer with a quick note explaining the correction. It’s transparent, professional, and keeps everyone on the same page.

Ready to create flawless, professional receipts in seconds? With ReceiptMake, you can choose from over 100 templates and generate the perfect receipt for any transaction—no sign-up required. Try it for free on ReceiptMake.com and see how easy it can be.

Article created using Outrank