How Long to Keep Business Receipts A Simple Guide

If you’ve ever stared at a mountain of receipts and wondered what to do with them all, you’re not alone. Figuring out how long to keep business receipts can feel like a guessing game, but it's simpler than it looks. The general rule of thumb is to hang onto most business records for three to seven years, though the specifics can change based on the type of document and where you do business.

Let's break down how to create a simple, stress-free system that works.

Why You Need a Receipt Retention Plan

It's easy to see receipt management as just another chore on your to-do list. But a better way to think about it is as financial armor for your business. A solid plan for keeping your records isn't just about tidying up—it’s a core strategy that protects your company and gives you peace of mind. Without one, you could easily overpay on your taxes, get hit with penalties, or find yourself unable to prove a transaction when you need to most.

Think of proper record-keeping as your first line of defense. It gives you the confidence to claim every single tax deduction you’re entitled to, which can significantly lower your tax bill. When tax season rolls around, you won't be digging through shoeboxes for a faded gas receipt. Instead, everything will be exactly where you need it, ready for you or your accountant.

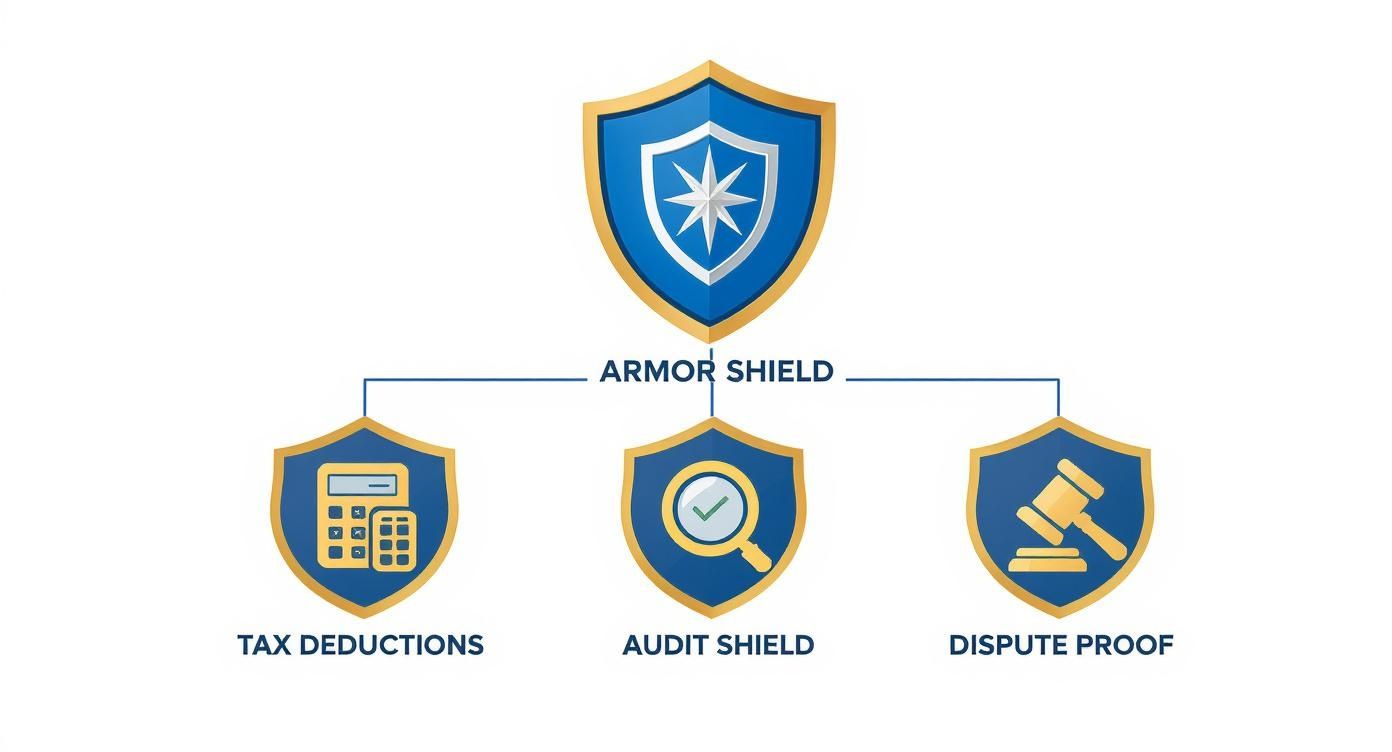

This diagram shows how a good retention policy acts as a shield for three critical parts of your business.

As you can see, the main goals are to maximize your tax deductions, build a solid defense against audits, and have clear proof ready for any disputes that might pop up.

Protect Your Business and Boost Your Bottom Line

Beyond just taxes, having your receipts organized is a huge help in your day-to-day operations. They are your definitive proof when you need to make a warranty claim, process a customer return, or sort out a billing error with a supplier. A clear record, like one made with a Parking Receipt Template, can shut down a disagreement before it even starts.

A well-documented transaction history is the foundation of financial clarity. It empowers you to track spending, manage budgets, and make informed decisions that drive growth.

In the end, a smart receipt retention plan takes the guesswork and stress out of managing your finances. It prepares you for the unexpected, like an IRS audit. If an auditor ever comes knocking, you’ll be able to hand over your records quickly and confidently, showing them you’re compliant and professional. By using a reliable Cash Receipt Template from the start, you ensure every record is clear and complete, setting your business up for success right from day one.

Decoding the Rules for Different Types of Receipts

Let's be honest, not all receipts are created equal. A receipt for a client coffee doesn't carry the same weight as the deed to your office building. Knowing how long to hang onto different types of records is the key to staying out of trouble.

Think of it this way: the "why" behind each rule is tied to what that receipt proves. Some are short-term evidence for an annual tax return, while others tell a much longer story about your company's assets or employees. Let's break down the main categories you’ll be dealing with.

Tax and Expense Records

This is the big one. When people talk about keeping receipts, they're usually thinking about the shoebox full of paper needed for tax season. These documents are your proof for every deduction and credit you claim.

- Income Records: Documents showing your gross receipts—think invoices, bank deposit slips, and sales summaries—should be kept for at least three years after you file the return they relate to.

- Expense Receipts: The same goes for your expense receipts. Whether it's for office supplies, software subscriptions, or business travel, you need to hold onto them for that same three-year period.

Why three years? That’s the standard window the IRS has to audit a tax return. But here's a pro tip: many accountants will tell you to hang on to everything for seven years. That longer period acts as a buffer, covering you in more complex situations where the audit window can be extended. So, for that business trip you took, make sure you have everything in order. A clean Hotel Receipt Template is perfect for ensuring all the crucial details for travel expenses are properly documented.

A good rule of thumb is to keep any record that supports an item of income, deduction, or credit shown on your tax return until the period of limitations for that return runs out.

Asset and Property Documents

Now we're moving into the long-haul records. When you buy a significant asset for your business—a new server, a piece of machinery, or a company vehicle—the purchase invoice becomes a foundational document. It's not just a simple expense; it establishes the asset's "cost basis," which is critical for its entire life with your company.

The rule here is simple but requires patience: keep these records for as long as you own the asset, plus three to seven years after you sell it, get rid of it, or finish depreciating it.

This paperwork is essential for calculating depreciation each year and for figuring out your capital gain or loss when the asset is sold. For example, if you buy a delivery truck and use it for ten years before selling it, you'll need that original bill of sale for at least 13 years.

Payroll and Employee Records

If you have a team, your record-keeping duties get a little more complex. Payroll documents are scrutinized by both tax authorities and labor departments, so getting this right is non-negotiable.

You need to keep all payroll-related records—timesheets, pay stubs, tax withholding forms (like W-4s), and proof of tax payments—for a minimum of four years. This ensures you can always prove you've paid your people correctly and handled all your tax obligations. It's about being prepared for any inquiry that might come your way.

Navigating International Record Keeping Rules

When your business starts operating across borders, figuring out how long to keep receipts can feel like you're trying to solve a puzzle with pieces from different boxes. Suddenly, compliance isn't just a local issue; it's a global one, and the rules change every time you cross a border.

For any company with a global footprint, getting a handle on the record-keeping laws in key regions is absolutely essential. While the basic idea is always the same—prove your income, justify your expenses—the timelines can be surprisingly different. Let's take a quick look at a few major countries to see how they stack up.

A Global Snapshot of Retention Policies

Even though the specific laws get complicated, you'll notice a general pattern among the tax authorities in major English-speaking countries. Each one sets a minimum timeline that should be the starting point for your own retention policy.

Here’s a quick comparison:

- United States (IRS): The IRS generally says to keep records for three years from the date you filed your original tax return. But that number can jump to six years if you've seriously under-reported your income, and it becomes indefinite if there's any suspicion of fraud.

- United Kingdom (HMRC): In the UK, Her Majesty's Revenue and Customs (HMRC) requires most businesses to keep records for at least five years after the 31 January tax submission deadline for that year.

- Canada (CRA): The Canada Revenue Agency (CRA) lands on the longer side, typically requiring you to keep your records for six years after the end of the last tax year they relate to.

Despite the different timelines, the mission is the same everywhere: have clear, accessible proof of your financial history ready for an audit or inquiry.

Adopting a Universal Ten-Year Standard

So, what do you do with all these different rules? Many international companies decide to just play it safe. Instead of juggling a complex web of country-specific policies, they set a single, longer retention period that covers all their bases. This is where the ten-year rule often comes in.

It turns out that while retention laws vary, a global survey found the most common legal requirement worldwide is ten years, a standard used in an incredible 96 countries. This makes it a really practical benchmark for any business trying to simplify its global compliance. You can discover more insights from this global survey on accounting record retention laws.

By holding onto all financial documents for a full decade, you’re pretty much ensuring you meet the legal requirements in any jurisdiction you might operate in. This approach slashes your risk and makes life a lot simpler for your internal teams. Whether you’re logging a small transaction with a Simple Receipt Template or tracking a major buy with a Purchase Receipt Template, applying a ten-year standard gives you a solid safety net for any questions that might come your way, no matter where they're from.

When You Need to Keep Records Longer

The three-year rule for keeping business receipts is a good baseline, but think of it as a starting point, not a hard-and-fast law for every situation. Certain circumstances can significantly extend the timeline, giving tax authorities a much wider window to look into your finances. Knowing these exceptions is key to building a record-keeping strategy that’s genuinely bulletproof.

Think of the standard three years as the "statute of limitations" on a clean, straightforward tax return. But if you've made a major mistake or left something significant out, that clock can get a lot longer. These special cases exist to give tax agencies the time they need to find issues that aren't obvious at first glance. Understanding what triggers these extensions helps you stay prepared and avoid painful penalties later on.

Understanding Extended Retention Periods

The most common reason you'll need to keep records longer is a major error in your tax filing. A small typo probably won't change anything, but a substantial miscalculation or omission definitely will. In the United States, for example, the IRS has very clear rules that outline exactly when you need to hang onto documents for more than three years.

This is why being meticulous with your records is so critical. It’s your only real defense if your return is questioned years after you filed it. You can learn more about specific data retention guidelines and what they mean for your business.

The burden of proof always falls on you, the taxpayer. Keeping your records organized and easy to access is the simplest way to back up your claims and get any inquiry resolved quickly.

Key Triggers for Longer Record Keeping

A few specific situations will automatically extend how long you must keep your business receipts. It's crucial to recognize these triggers and adjust your policy. For example, if you use a car for work, keeping detailed fuel records is a must. Using a consistent Gas Receipt Template is a great way to make sure you capture all the required details every time you fill up.

Here are the main reasons you might need to hold onto documents well beyond the standard three years:

- The 6-Year Rule for Underreported Income: If you fail to report more than 25% of your gross income, the audit window stretches to six years. This isn't just about deliberate cheating—an honest but large mistake can easily trigger this rule.

- Indefinite Retention for Fraud or No Return: If you don't file a return at all, or if the government suspects fraud, there is no statute of limitations. That means they can come knocking anytime in the future, which makes keeping those records permanently a very good idea.

- 7-Year Rule for Bad Debt or Worthless Securities: If you claim a deduction for a bad business debt or a loss from a worthless security, the recommendation is to keep those records for seven years.

These exceptions really drive home how important it is to be accurate and honest with your financial reporting. When you keep clean, complete records, you aren't just preparing for a standard audit; you're building a strong defense against the very scenarios that could bring you trouble years from now.

Building Your Smart Receipt Management System

Knowing the rules is one thing, but putting them into practice is what really counts. Building a smart system for managing your receipts doesn't have to be complicated or expensive. It's really just about creating a simple, repeatable process that saves you time, space, and a whole lot of stress down the road.

The goal here is to trade that shoebox full of crumpled papers for an organized, searchable digital archive. Let's be honest, paper receipts are a liability. They fade, rip, get lost in a drawer, and take up physical space. A digital system is a massive upgrade for any modern business.

From Paper Piles to Digital Power

Making the switch to digital isn't just about saving space; the real wins are in efficiency and security. Think about it: you can find a specific receipt from two years ago in seconds with a simple search. Try doing that with a box of random papers.

A digital receipt system also protects your vital financial records from physical disasters like fire, floods, or even just a coffee spill. When you add cloud backups, your records aren't just safe—they're accessible anywhere, anytime.

This small shift turns record-keeping from a painful chore you put off into a real asset for your business. It makes bookkeeping smoother, tax time less of a nightmare, and an audit request a simple, stress-free task.

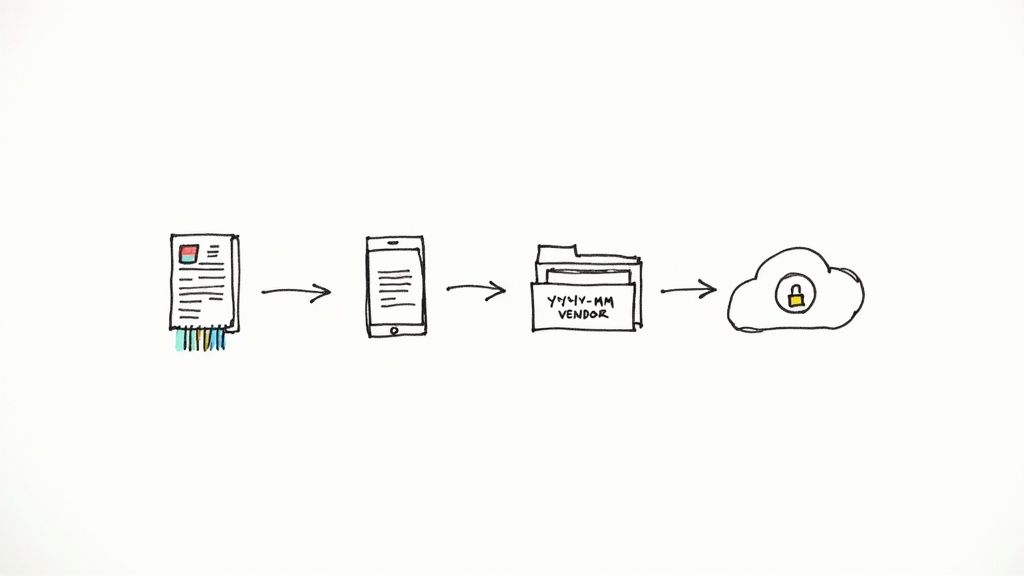

Your 4-Step Workflow for Perfect Records

You don't need a fancy accounting degree or expensive software to get this right. All it takes is consistency. Follow these four steps, and you’ll have a rock-solid system working for you.

Create and Capture Everything: For every transaction you make, generate a clean receipt with all the right details. When you receive a receipt from a purchase, scan it or snap a clear picture with your phone right away. Don't let it sit in your wallet for a week.

Organize with a Clear Naming Convention: This is the secret sauce to a searchable archive. Save every file with a logical name that tells you what it is at a glance. A fantastic format is Year-Month-Day-Vendor-Amount (e.g.,

2024-10-26-OfficeSupplies-78.50.pdf).Use a Centralized Digital Folder System: It’s simple, but it works. Create a main folder for each tax year. Inside that, make subfolders for categories like "Income," "Expenses," "Assets," and "Payroll." This setup perfectly mirrors how you'll need the information for your taxes.

Back It All Up Securely: A single digital copy is still a risk. Use a trusted cloud storage service like Google Drive, Dropbox, or OneDrive to automatically back up your receipt archive. This gives you a safety net, so if your computer dies, your records don't die with it.

Stick to this workflow, and you'll not only know how long to keep your receipts but also have them perfectly organized whenever you need them.

If you need to generate professional-looking receipts for your own sales, you can explore our full range of receipt templates to find one that fits any kind of transaction.

Common Questions About Business Receipts

Now that we’ve walked through the rules and strategies for managing your business records, let's tackle some of the practical questions that always pop up. Think of this as a quick-fire round, answering the real-world situations you're bound to run into.

These are the kinds of details that can trip people up, but getting them right makes your whole system stronger and keeps you prepared for anything.

Are Digital Copies of Receipts Legally Valid?

Yes, absolutely. Tax authorities in most major countries, including the IRS in the US, HMRC in the UK, and the CRA in Canada, are perfectly happy with digital copies. There's just one crucial catch: the digital version must be a clear, complete, and accurate copy of the original.

That means every important detail—the vendor's name, the date, the itemized list of what you bought, and the total amount—has to be perfectly readable. A good scan or a clear photo from your phone works great. In many ways, digital is even better because it saves your records from fading, getting damaged, or being lost. Just make sure you have a secure backup.

What Should I Do If I Lose a Receipt?

First off, don't panic. Losing a receipt happens, but you need to take a few steps to fix it. The first thing to do is find other proof of the purchase, like a bank or credit card statement showing the transaction. While that's a good start, it usually doesn't show the itemized details that an auditor would want to see.

Your next best move is to contact the vendor and ask for a duplicate. Many businesses can easily reprint an invoice or email you a copy. If that's not possible, your final option is to create a written record of your own, noting the date, amount, vendor, and the specific business purpose of the expense. To avoid this hassle in the future, you can create a record on the spot using something like a Taxi Receipt Template to fill in the gaps.

Do I Really Need to Keep Receipts for Small Expenses?

It’s a very smart habit to get into. While some tax laws are a bit more relaxed for small expenses—for example, some deductions under $75 in the US don't strictly require a receipt—you still have to prove the expense happened.

Keeping every receipt, no matter how small, makes your financial records airtight. It leaves no room for doubt and ensures you can confidently claim every deduction you're entitled to.

Think about it: all those little expenses can easily add up to thousands of dollars in legitimate write-offs over the course of a year. A simple, clean record, like one you can create with a Generic Sales Receipt Template, provides all the proof you need.

How Do I Securely Dispose of Old Receipts?

Once a receipt is past its retention date, you need to get rid of it the right way. Just tossing financial documents in the trash or recycling bin is a bad idea—it can expose sensitive business information and open you up to identity theft.

For paper receipts, a cross-cut shredder is your best tool. It dices the documents into tiny pieces that are nearly impossible to put back together. For digital files, just dragging them to the trash bin isn't enough, as the data can often be recovered. You'll want to use a secure file deletion tool, sometimes called a "digital shredder," to permanently wipe the information from your drive.

Ready to create clear, professional records for every transaction? With ReceiptMake, you can generate perfect receipts in seconds using over 100 templates. Start making your record-keeping easier today, for free, at https://receiptmake.com.