difference between invoice and receipt: Quick guide

It all boils down to one simple distinction: an invoice asks for money, while a receipt proves the money was paid.

Think of it like this: an invoice is the bill you send out for your work or products. It's the "please pay me" document. A receipt, on the other hand, is the "thank you, I've received your payment" confirmation that closes the loop. You can use a dedicated Receipt Template to make this process seamless.

Invoice vs Receipt: The Fundamental Difference

Getting the hang of these two documents is non-negotiable for any business owner. It's crucial for managing your cash flow, keeping your books straight, and staying on the right side of the law. While they're both part of the same transaction, they show up at opposite ends of the process. The invoice kicks things off, and the receipt officially wraps it up.

Though they might seem similar, invoices and receipts play completely different roles. An invoice is a formal request for payment that you issue before a customer pays you. A receipt, like one from a Donation Receipt Template, is generated after the payment comes through, acting as proof that the deal is done and the money has changed hands.

This distinction is more than just semantics. Invoices are how you track your accounts receivable—the money people owe you. Receipts are your proof of income, essential for everything from tax deductions to handling customer returns. You can discover more insights about this distinction and why it's so vital for your business.

This visual gives a great side-by-side breakdown, showing how one document requests payment and the other confirms it.

As the infographic shows, an invoice is the formal "ask," and the receipt is the final "proof."

Key Differences at a Glance: Invoice vs Receipt

To make it even clearer, let's break down the core functions and characteristics of an invoice and a receipt in a simple table.

| Attribute | Invoice | Receipt |

|---|---|---|

| Primary Purpose | To request payment from a customer. | To confirm payment has been received. |

| When It's Issued | Before payment is made. | After payment has been successfully completed. |

| Who Sends It | The seller sends it to the buyer. | The seller provides it to the buyer. |

| Financial Role | Tracks accounts receivable (money owed). | Records cash or revenue received. |

| Legal Status | A formal request, not proof of payment. | Legal proof of a completed transaction. |

This table lays out the essential differences, showing they are two distinct tools for different stages of a sale.

Ultimately, knowing when to use a detailed service invoice template versus a simple cash receipt template is a cornerstone of professional financial management.

What an Invoice Actually Does for Your Business

Think of an invoice as more than just a bill. It's a formal request for payment that keeps your business's cash flow healthy. By laying out exactly what goods or services you provided, it creates a professional record of the transaction before you get paid, making sure you and your client are on the same page. This document is the lifeblood of your accounts receivable, helping you keep track of who owes you what, and when it’s due.

For freelancers and anyone in a service-based industry, a solid invoice is non-negotiable. Using a good service invoice template from the start ensures you cover all your bases, from an itemized list of your work to the payment terms you both agreed on. That kind of clarity is what prevents headaches and gets you paid on time.

The Essential Components of an Invoice

To do its job right, every invoice needs a few key pieces of information. These details protect both you and your customer and make the whole process run smoothly.

Here’s what every professional invoice should have:

A Unique Invoice Number: This is your best friend for tracking. It gives you and your client a simple way to reference a specific transaction if any questions pop up.

Detailed Line Items: Break down exactly what you’re charging for. List each product or service with the quantity, rate, and a subtotal for each line.

Clear Payment Terms: Don't leave this to guesswork. State the payment deadline (like "Net 30" or "Due upon receipt") and what payment methods you accept.

Total Amount Due: The final number should be impossible to miss. Make sure it clearly includes any taxes, discounts, or shipping fees.

Getting these details right matters more than you might think. The global market for electronic invoicing is expected to hit nearly $36.72 billion by 2032, simply because businesses need accurate records for taxes and efficient operations. It's a clear sign of just how vital proper invoicing has become. Discover more about the e-invoicing market trends.

Different Invoice Types for Different Scenarios

Business isn't a one-size-fits-all world, and neither are invoices. There are different types designed for specific situations, and knowing which one to use keeps your financial communication professional and accurate.

The type of invoice you send tells a story about where you are in the transaction. A pro forma invoice is like a preview, while a recurring invoice is for the long haul, saving you a ton of admin time.

For example, you'd send a pro forma invoice before you even start the work, giving the client a heads-up on the estimated cost. On the other hand, a recurring invoice is perfect for ongoing work, like monthly retainers or subscriptions, putting your billing on autopilot. And if you're selling goods that need to be shipped, a specialized commercial invoice template is often the way to go, as it has all the extra details needed for customs. Picking the right tool for the job can be the difference between a seamless transaction and a confusing mess.

Why Receipts Are Your Proof of a Done Deal

Think of it this way: if an invoice is the request for payment, a receipt is the official handshake that says the deal is done. It’s the final, undeniable proof of payment that confirms money has changed hands and the transaction is complete. While an invoice shows what's owed, a receipt closes the loop by confirming the debt is paid.

For your customer, that little piece of paper (or email) is their peace of mind. It’s what they need to track expenses, make a return, or file a warranty claim. Without a receipt, they have no formal proof they ever paid you, which can quickly turn into a frustrating dispute.

For your business, receipts are a critical part of the financial puzzle. Each one serves as a vital record for tracking your revenue accurately and making tax time a whole lot simpler. Every receipt you issue becomes a data point, helping you see sales trends and keep your books clean, compliant, and ready for any audit. A good Payment Receipt Template can standardize this process.

What Every Receipt Must Contain

A proper receipt needs a few key details to be useful. Including this information ensures there’s no confusion for you or your customer, making it a reliable record of the transaction.

Here are the non-negotiable elements:

Business Details: Your business name, address, and contact info.

Date of Transaction: The exact date the payment was made.

Itemized List: A clear breakdown of the products or services sold.

Total Amount Paid: The final sum the customer paid, including all taxes.

Payment Method: How they paid you (e.g., cash, credit card, bank transfer).

These components turn a simple slip of paper into a powerful legal and financial document. It’s the final word, confirming you delivered what you promised and the customer held up their end of the bargain.

A receipt isn't just a formality; it's the final, authoritative record of a completed exchange. It resolves any ambiguity left by an invoice by definitively stating, "This transaction is paid in full."

Creating Professional Receipts with Ease

You don't need to overcomplicate things when it comes to making receipts. While you could start from scratch, using a good template makes sure you never forget a crucial detail and maintain a professional look with every single sale.

This is a game-changer for small businesses where every minute counts. For example, a versatile target receipt template can make your checkout process smooth and consistent, whether you're at a pop-up market or a brick-and-mortar shop. It guarantees every customer leaves with clear, compliant proof of their purchase, which builds trust in your brand and keeps your own records spotless.

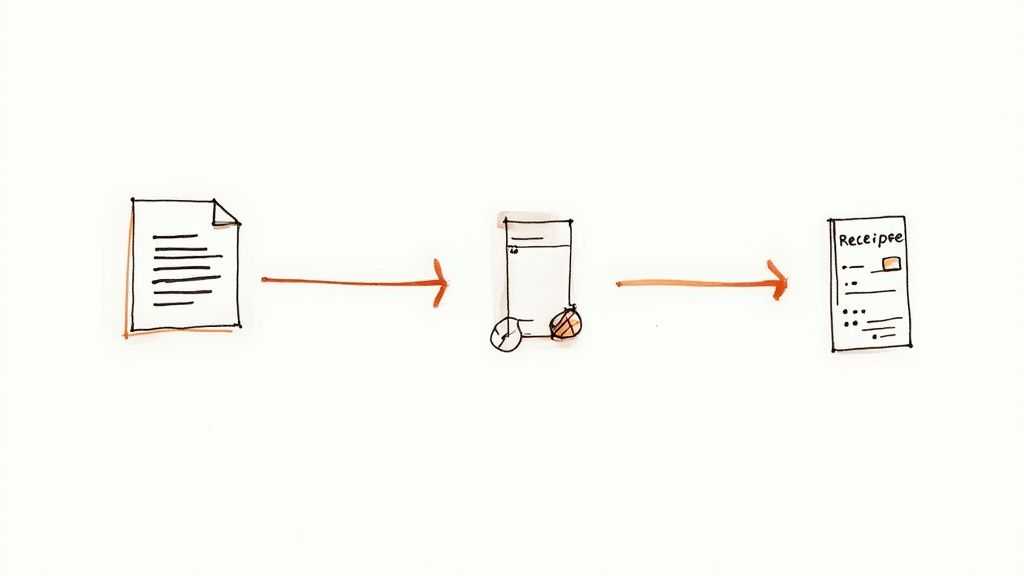

Mapping the Transaction: When to Send Each Document

Knowing when to send an invoice versus a receipt is a fundamental part of running a business smoothly. Get the timing wrong, and you can create confusion, slow down payments, and even look unprofessional. Each document has its specific place in the lifecycle of a transaction.

The flow is simple: an invoice kicks off the payment process, while a receipt closes it out.

Think of it this way: an invoice is a polite but firm request for payment. It details what you did, what it costs, and when the money is due. On the flip side, a receipt is the confirmation that says, "Thanks, I got the money." It’s proof of purchase for your client and a signal for you to close the book on that sale.

Mixing them up is a common but costly mistake. Sending an invoice when you should send a receipt implies the client still owes you money, which can damage trust. This natural progression from request to confirmation ensures every stage is clearly documented, leaving no room for disputes.

A Real-World Transaction Flow

Let's walk through a classic example. Imagine you're a freelance graphic designer who just wrapped up a logo project for a new client. The work is done, and now it's time to get paid.

Here’s how the timeline should look:

Work Completion & Invoice Issuance: As soon as the client approves the final logo designs, you create and send an invoice. This document will list the services like "Logo Design Package," your rate, the total amount due, and your payment terms (e.g., Net 15). This officially starts the clock on the payment.

Client Makes Payment: The client gets your invoice and pays you through one of your accepted methods, whether that's a bank transfer, credit card, or an online portal. The money is now heading to your account.

Payment Confirmation & Receipt Issuance: Once you confirm the payment has landed in your account, you immediately create and send a receipt. This document is the client’s proof that they’ve paid their bill in full. For your own bookkeeping, it marks that invoice as "Paid."

This simple sequence is the backbone of professional financial management. It creates a clean, documented paper trail from the initial request to the final settlement.

Invoice First, Payment Second, Receipt Last. This simple but critical order is the key to managing your transactions effectively. It ensures you request payment formally and provide undeniable proof once it's received.

Sticking to this timeline helps you avoid awkward follow-up emails and keeps your financial records squeaky clean. After the payment is confirmed and the receipt is sent, you can log the transaction as complete. If you need to create professional proof of payment on the fly, you can generate a custom receipt in just a few clicks.

Why Keeping Good Records Isn't Just an Option—It's Essential

Getting the hang of invoices and receipts isn't just about tidy paperwork. It's a fundamental part of keeping your business on the right side of the law and financially sound. These two documents play very different, but equally important, roles. Getting them wrong can lead to some serious headaches, from tax penalties to legal troubles.

Think of it this way: an invoice is your formal request for payment. It’s you telling a client, "Here’s what I delivered, and this is what you owe me." A receipt, on the other hand, is the proof that the deal is done. It’s your confirmation of income received and your client’s proof that they’ve paid up.

When tax time rolls around, authorities like the IRS want to see the paper trail. Your invoices back up the income you're reporting, while your receipts are the key to claiming all the business expenses you’re entitled to. Without them, you’re not just risking an audit—you're likely leaving money on the table.

Invoices as Your Legal Backup

An invoice isn’t a contract in the traditional sense, but once a client accepts what you've provided, it effectively becomes a legally recognized agreement. It lays out the terms you both agreed to—the scope of work, the price, and when you expect to be paid. If a payment issue crops up, that invoice is your best friend.

Imagine a client simply refuses to pay. A detailed invoice is your first and most powerful piece of evidence. It clearly shows you held up your end of the bargain and that they have an outstanding debt. Trying to chase down that payment without a proper invoice is an uphill battle.

Good record-keeping is the backbone of financial integrity. Your invoices and receipts tell the complete story of your business transactions, protecting you from legal challenges and ensuring you meet your tax obligations accurately.

Receipts: Your Shield Against Tax Audits

For tax purposes, receipts are everything. Every single deduction you claim, whether it’s for new software or a coffee meeting with a client, needs to be supported by a receipt. It's the undisputed proof that the expense was legitimate and directly related to your business.

For instance, a clear receipt from a supplier solidifies your cost of goods sold, directly impacting your taxable profit. You can create clean, compliant proof of these transactions with a Purchase Receipt Template to make sure your records are always in order.

The IRS has specific rules about how long you need to hold onto these records. It’s not forever, but it’s longer than you might think. Here’s a quick rundown:

3 Years: This is the standard. You should keep records for three years from the date you filed your tax return. This covers most of your day-to-day income and expense documents.

6 Years: If you happen to underreport your income by more than 25%, the IRS requires you to keep those records for six years.

7 Years: For specific claims, like a loss from worthless securities or a bad debt deduction, you need to hang onto your records for seven years.

Neglecting to keep these documents can lead to denied deductions, which means paying more in taxes, plus potential penalties. Keeping everything organized with something like a Business Receipt Template can make a potential audit far less painful.

How to Create Professional Invoices and Receipts

When you're running a business, every document you send out is a reflection of your brand. Clear, professional paperwork isn't just about getting paid; it’s about building trust. Whether you’re sending an invoice to ask for payment or a receipt to confirm it, getting it right matters.

You could create them from scratch every time, but who has that kind of time? Using a good template is a much smarter move. It ensures all the essential details are there, every single time. A specialized Rent Receipt Template is perfect for landlords, for example.

This approach doesn't just save you a headache; it also keeps your branding consistent and your records compliant. You can stop worrying about formatting and focus on what you do best.

Quick Steps for Crafting an Invoice

When it's time to bill a client, a solid invoice is your best friend. It needs to tell your client exactly what they owe and when you expect to be paid. No confusion, no delays.

Here’s a simple breakdown of what to do:

Brand Your Document: Add your logo and business contact info right at the top. It looks professional and makes you easy to reach.

Include Essential Details: Every invoice needs a unique invoice number, the date it was issued, and a clear payment due date. This is non-negotiable for proper tracking.

Itemize Services or Products: Don't just put a total. List out every service or product with a clear description, quantity, and price. Transparency is key.

State Payment Terms: Show the subtotal, add any taxes, and present the final total in bold. Be sure to list the ways you accept payment (e.g., bank transfer, credit card).

A great invoice leaves no room for questions. It acts as a clear, formal request that guides your client through the payment process and helps you get paid faster.

Creating a Receipt After Payment

Once the money hits your account, the job isn't quite done. Sending a receipt promptly closes the loop professionally. It’s the customer's proof of purchase and your record of income.

This is where a good business receipt template can make life easier, helping you quickly fill in details like the payment date and method.

If you’re a freelancer, consultant, or run any other service-based business, a dedicated Service Invoice Template is just as crucial for accurate billing. By exploring a range of high-quality invoice and receipt templates, you can find the perfect fit for any transaction and keep your financial communications looking sharp.

Frequently Asked Questions

Even when you know the difference between an invoice and a receipt, real-world situations can get a little fuzzy. Let's clear up some of the most common questions that pop up so you can handle every transaction like a pro.

Can an Invoice Be Used as a Receipt?

In a word, no. They’re two different tools for two different jobs and shouldn't be mixed up. An invoice is a bill—it’s asking for money that’s owed. A receipt is the proof that the money has been paid.

Trying to use an invoice as proof of payment just creates bookkeeping headaches and confuses your customers. Once you receive the money, always send a proper receipt to officially close the loop. For simple transactions, a Cash Receipt Template is perfect for providing quick, clear proof.

Do I Need to Send a Receipt After an Invoice Is Paid?

Absolutely. Sending a receipt isn't just good practice; in many cases, it's a legal must-have. While the invoice tracks the amount due, the receipt gives your customer solid proof that they've paid up.

This simple final step is key to keeping clean books for both you and your customer. It prevents any "did you or didn't you pay?" disputes down the road and builds trust by confirming the deal is done. A straightforward sales receipt template gives your customer exactly what they need.

An invoice asks the question, "Will you pay me?" A receipt answers with a definitive, "Yes, you've been paid." This distinction is the core of accurate financial record-keeping.

What Is a Tax Invoice?

A tax invoice is a special kind of invoice that’s required in many countries if you need to handle taxes like GST or VAT. It contains specific details that aren't always on a standard invoice.

The big additions are usually your business's tax ID (like an ABN or VAT number) and an itemized breakdown of the tax charged on your products or services. These rules change depending on where you are, so always check your local tax laws to stay compliant. A flexible Commercial Invoice Template can often be adjusted to meet these requirements.

Ready to create clear, professional documents in seconds? With ReceiptMake, you can generate unlimited custom receipts for free. Choose from over 100 templates and create the perfect proof of payment for any transaction. Start creating your free receipt now.