Your Guide to Using a Cash Receipt Book Like a Pro

Think of a cash receipt book as the original, offline record-keeper for your business's cash. It's a simple, physical log where you jot down every single cash payment that comes in. At its core, it gives both you and your customer a tangible piece of paper proving a transaction happened, which builds a surprising amount of trust and clarity.

What Is a Cash Receipt Book and Why It Matters

Before apps and software, there was the humble cash receipt book. It's the foundational diary for your business's income, a straightforward tool designed for one crucial job: to manually track every dollar you receive. For freelancers, small shop owners, and market vendors, this is often the very first step toward getting financials organized.

This simple book turns a fleeting handshake deal into a concrete record. Each entry tells the basic story of a sale, creating a reliable paper trail that protects everyone involved. It’s a system built on common sense, and it eliminates a lot of guesswork and potential disputes down the road.

The Anatomy of a Cash Receipt

Every good receipt, whether torn from a spiral-bound book or generated from a digital cash receipt template, needs to have a few key ingredients. These pieces of information work together to paint a clear, trustworthy picture of the transaction.

Here’s what you'll always find:

- Date: Pinpoints the exact day the money changed hands.

- Payer Information: A name or business that identifies who paid you.

- Amount Paid: The specific sum, often written in both numbers and words to prevent tampering.

- Purpose of Payment: A quick note on the product or service sold.

- Recipient’s Signature: Your confirmation that you received the payment.

Without these details, a receipt is just a scrap of paper. With them, it becomes a powerful little document that validates the exchange and makes your business look professional.

More Than Just a Record

A well-kept cash receipt book does more than just track incoming money—it serves a much bigger purpose. It’s a vital tool for any small business, directly helping with solving cash flow problems by creating a crystal-clear log of all your income. That clarity is the bedrock of good financial health.

Think of it this way: your receipt book is your business's financial memory. It ensures no payment gets lost in the shuffle and every dollar is accounted for. It's your first line of defense against messy bookkeeping and a cornerstone of customer trust.

Ultimately, this simple book is building a financial history, one sale at a time. That history becomes indispensable when you're tracking performance, getting ready for tax season, or making smart decisions about where your business is headed. It forces you into a discipline of accountability from day one.

How to Fill Out a Cash Receipt Step by Step

Knowing what a cash receipt is and actually filling one out correctly—especially with a customer waiting—are two different things. Let's walk through it with a real-world example.

Imagine you're selling handmade pottery at a local market. A customer falls in love with a large ceramic vase and pays you $75.00 in cash. Now you need to give them a receipt. This small piece of paper is more important than you might think. It gives the customer proof of purchase and gives you a vital record for your books. A neat, complete receipt makes your business look professional and keeps everything straight.

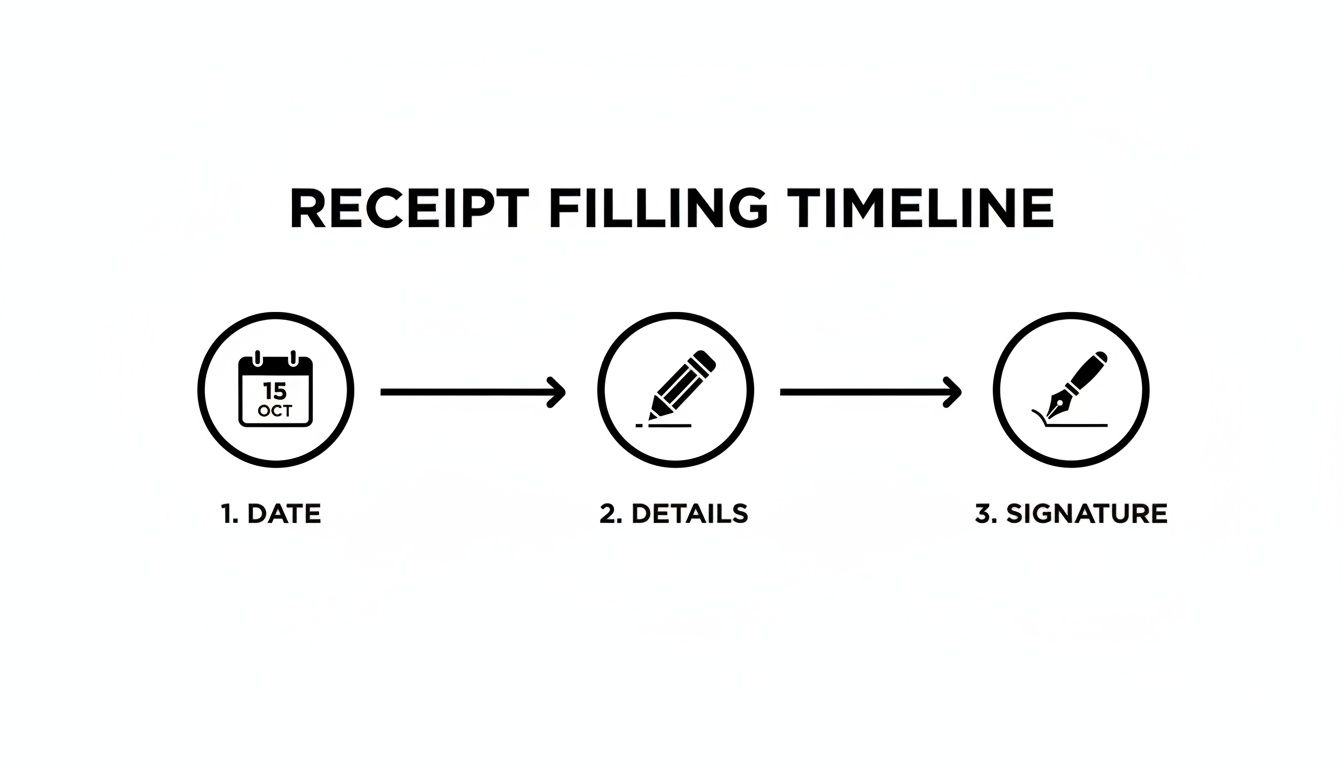

Step 1: Enter the Date and Payer Details

First things first, get the date down. This is non-negotiable. The date pins the sale to a specific day, which is crucial for good bookkeeping and, eventually, your taxes. Write it clearly at the top.

Next, get the customer's name. A simple "Who should I make this out to?" works perfectly. Writing their full name in the "Received From" field makes the transaction personal and easy to look up later if they have a question.

Step 2: Document the Payment Amount and Purpose

This is where you need to be precise. You’ll write the amount twice, and there’s a good reason for that—it prevents mistakes and tampering.

- In Numbers: Write the total amount numerically (e.g., "$75.00"). Make it legible.

- In Words: Write the same amount out longhand (e.g., "Seventy-five and 00/100 dollars"). This written-out version is a classic security measure.

Then, add a quick note about what the payment was for. Something like "One large ceramic vase" is all you need. It connects the dollar amount to a specific item, jogging both your memories down the line.

Step 3: Finalize with a Signature and Distribute Copies

Your signature is the final touch. Signing the receipt makes it official—it’s your confirmation that you received the cash.

Now for the best part of old-school receipt books: the carbon copy.

A cash receipt book is a brilliant two-part system. The top white copy is for the customer. The thin, colorful copy underneath stays in your book. This simple design ensures both of you have an identical record of the sale.

Carefully tear the original receipt along the perforated line and hand it to your customer. That second copy—usually yellow or pink—is your permanent record, tucked away safely in the book. It’s your proof if any questions pop up later.

While physical books are great, this same logic applies to digital tools. For example, a good service receipt template mirrors this structure, helping you create clean, professional records right from your computer or phone.

By following these simple steps every single time you take a cash payment, you build a solid habit of great record-keeping. Your cash receipt book becomes more than just a pad of paper; it’s a fundamental tool that helps you track every dollar and run a tight, organized business.

The Journey from Paper Receipts to Digital Records

The humble paper receipt wasn't born in an accountant's office. It started in a 19th-century saloon, where a fed-up owner needed a way to stop his staff from dipping into the cash drawer. That simple, everyday problem sparked an invention that would completely change how business is done.

The story of the cash receipt book is really a story about technology and trust. It tracks our journey from clunky mechanical registers to the instant thermal prints we get today. Every step forward was about making transactions faster, more accurate, and more secure. Seeing this history makes it clear why moving to digital isn't some new fad—it's just the next logical step in a very long evolution.

The Birth of Accountability

Before we had automated records, business ran on a handshake and trust. That all changed in 1879 when James Ritty, a saloon owner from Dayton, Ohio, invented what he called the "Incorruptible Cashier." He was inspired by a device on a steamboat that counted the propeller's rotations and figured he could do the same for sales. His machine punched out a small paper ticket—the world's first cash receipt.

For the first time, business owners had reliable, physical proof of a transaction. It was a game-changer for tracking income and preventing theft. You can explore more about the history of receipts to see just how quickly this idea caught on.

The concept was an instant hit and was quickly improved upon. The National Cash Register Company (NCR) developed machines with hand cranks that printed out full receipts, which meant managers no longer had to fill out forms by hand. This saved a ton of time and made everything far more accurate, especially in a busy shop.

From Carbon Copies to Thermal Paper

As businesses got bigger, so did the need for better ways to keep records. A huge leap forward was the carbon-copy receipt book. This simple innovation allowed a business to create an instant duplicate of every receipt—one for the customer, and one for the books. It was a brilliantly effective system that became the standard for decades.

Then, in 1969, thermal paper arrived and changed the game again. By using heat-sensitive paper, businesses could print receipts without messy ink ribbons or cartridges. This made printing faster, quieter, and cheaper. It also allowed for more detailed, itemized receipts that could show things like tax calculations and other important info. It’s a technology that’s still a staple in stores and restaurants today.

Even with all these changes, the fundamental steps of creating a receipt have stayed the same.

From writing down the date to filling in the details and getting a signature, these core actions have been the bedrock of proving a transaction for over a century.

The Modern Shift to Digital

Today, that evolution is taking us toward digital records. Paper receipts did their job well, but they have their downsides. They take up physical space, the ink can fade over time, and they have a pretty big environmental footprint. Making all that paper consumes millions of trees and a massive amount of water each year.

This history shows us that the goal has always been the same: to create an accurate, reliable, and efficient record of every transaction. Digital tools are simply the modern answer to that age-old challenge.

Modern solutions, like online receipt generators, carry on the legacy of the cash receipt book while fixing its flaws. For example, you can create a professional cash receipt or a detailed sales receipt online in just a few seconds.

These digital tools offer the same accountability as their paper ancestors but add modern benefits like instant delivery, effortless organization, and zero waste. They’re the next natural step in the journey, making professional record-keeping accessible to everyone.

Keeping Your Cash Receipt Book for Audits and Compliance

A well-kept cash receipt book is more than just a list of payments. Think of it as your financial bodyguard—it’s your primary defense during an audit and the foundation of your business's financial transparency. This simple paper trail offers undeniable proof of income, something you can't do without during tax season or any internal review.

When your records are organized, it shows you're running a professional and responsible operation. It's the backbone of a compliant business, ensuring every dollar is accounted for and you can confidently answer any questions that come your way.

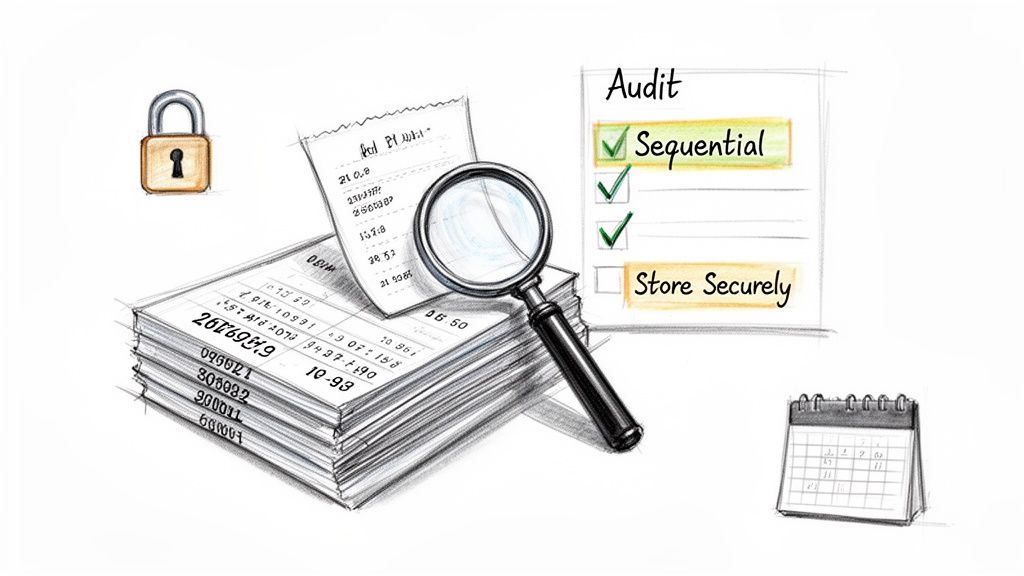

Sequential Numbering: The First Rule of Order

One of the smartest features of a pre-printed cash receipt book is the sequential numbering. Every single receipt has its own unique, pre-assigned number, creating a clean, unbroken chain of transactions. It’s a beautifully simple system that acts as your first line of defense against missing records.

If you see receipt #52 followed immediately by #54, you know instantly that something is missing. This makes it incredibly hard for a record to get lost or intentionally removed without leaving a glaring hole. For an auditor, seeing a complete numerical sequence is a big green flag that points to diligent and honest bookkeeping.

Secure Storage and Retention Guidelines

Once you fill up a cash receipt book, its job is far from over. It graduates into a vital historical document that needs to be protected. Find a secure, dry place to store these completed books—somewhere safe from water damage, pests, or even just fading sunlight.

Tax authorities like the IRS have specific rules for how long you need to keep financial records. The general rule of thumb is to hold onto your receipt books for a minimum of three years from the date you filed your tax return. But be careful, that period can stretch to six years or even indefinitely in certain cases, like if you significantly underreport your income.

Your old receipt books are your financial archive. They contain the raw data that supports your tax filings and financial statements, making them invaluable if your records are ever questioned.

Reconciling Your Records for Accuracy

Just writing things down isn't enough; you need to check your work. Regular reconciliation is a crucial habit that helps you spot errors, catch oddities early, and even deter potential fraud. It’s all about cross-checking the information in your book against your other financial data.

Here’s a simple routine to get into:

- Match Cash on Hand: At the end of each day or week, count the cash you've brought in. Does it match the totals you wrote down in your receipt book?

- Compare with Bank Deposits: Make sure the amounts you deposit into your bank account line up with the cash receipts you’ve logged for that period.

- Review for Irregularities: Every so often, just scan through the book. Look for anything that feels off, like a break in the receipt numbers or entries that just don't look right.

Think of this as a mini-audit you perform on yourself. It builds a habit of accuracy that will save you headaches down the road.

The core ideas behind manual bookkeeping have been around for centuries, with pre-numbered journals serving as a cornerstone since the 1500s. In modern accounting, a cash receipts journal is a detailed ledger for every cash inflow, and this meticulous tracking is known to prevent a significant amount of theft in cash-heavy businesses. The IRS officially gave the green light to digital equivalents in 1997, as long as they are legible and properly maintained. You can discover more about how modern bookkeeping builds on these historical practices.

Modern tools make this even easier. For example, creating an IRS-compliant invoice receipt or a standard payment receipt with a tool like ReceiptMake ensures all the necessary details are included automatically, making your digital records just as robust for compliance.

Choosing Between Digital and Physical Receipts

Sooner or later, every small business owner or freelancer hits a fork in the road: stick with the old-school cash receipt book or go digital? It’s a bigger decision than just paper versus pixels. It’s about how you manage your time, money, and the professional image you show your customers. Both methods get the job done, but they offer completely different ways of working.

A physical receipt book has a certain charm, doesn't it? It’s simple. It works anywhere, anytime—no Wi-Fi, no dead battery, no software updates to worry about. For anyone running a stall at a farmers' market or a pop-up at a craft fair, that tactile, reliable feel is hard to beat.

But that simplicity has a downside. Paper is fragile. Receipts get lost, coffee gets spilled, and ink fades. Storing stacks of old receipt books takes up real estate in your office, and trying to find one specific sale from six months ago can feel like an impossible treasure hunt.

A Head-to-Head Comparison

Let's put the classic cash receipt book and a modern digital receipt generator side-by-side. Seeing the differences laid out clearly can make the choice a lot easier.

The decision often comes down to what you value more: the offline simplicity of paper or the online efficiency of digital.

| Feature | Cash Receipt Book (Physical) | Digital Receipt Generator (e.g., ReceiptMake) |

|---|---|---|

| Cost | Low initial cost for the book, but ongoing expense for new books. | Often free or low-cost subscription; no recurring paper costs. |

| Convenience | No power or internet needed, but requires manual entry for every field. | Instant generation and sharing via email; accessible from any device. |

| Organization | Records are chronological but require manual searching. | Instantly searchable by date, customer, or amount; easy to categorize. |

| Security | Susceptible to physical loss, damage, or unauthorized access. | Records can be backed up to the cloud or local storage, reducing risk of loss. |

| Professionalism | Can look basic; handwriting may be difficult to read. | Creates clean, professional, and branded receipts with your logo. |

| Environmental Impact | Requires paper, contributing to waste and resource consumption. | Completely paperless, reducing your business's environmental footprint. |

While a paper book is a trusty tool in a pinch, it’s clear that digital solutions offer huge advantages in day-to-day efficiency and organization. The ability to calculate totals on the fly, find any transaction in seconds, and email a receipt instantly just makes life easier.

The Major Wins for Digital Receipts

Switching to a digital system isn't just about saving paper. It fundamentally changes how you handle your records for the better, giving you back time and reducing headaches.

Here are some of the biggest perks:

- Instant Search and Retrieval: Remember that one sale from last April? Instead of flipping through a dusty book, you can just type and find it. Done.

- Automatic Calculations: Digital tools do the math for you—calculating totals, adding taxes, and applying discounts. This ensures every single receipt is 100% accurate.

- Effortless Sharing: You can send a professional receipt to a customer’s email before they’ve even walked out the door. It’s a clean, immediate confirmation of their purchase.

- Enhanced Branding: Add your logo and brand colors to every receipt. It’s a small touch that makes your business look polished and established.

The shift from paper to digital is less about replacing a tool and more about upgrading a process. It takes the fundamental principles of good record-keeping—accuracy, clarity, and proof of transaction—and makes them faster, smarter, and more secure.

For anyone ready to make the jump, there are plenty of options out there. A great first step is to explore different receipt templates to see what's possible. You can create everything from a simple proof of payment to a detailed, itemized bill for services rendered.

Finding the right template means you’ll always capture the information you need in a format that's clean and easy for your customers to understand. That kind of flexibility and professionalism is exactly why so many businesses are leaving their paper books behind.

When and How to Switch to a Digital Receipt Generator

While a physical cash receipt book has its reliable charm, there comes a point for every growing business when it starts to feel less like a simple tool and more like a bottleneck. Knowing when to make the leap to a digital solution is key to keeping your operations running smoothly.

The signs are usually pretty obvious. If you're spending more time handwriting receipts than serving customers, or if finding an old transaction feels like searching for a needle in a haystack, it’s probably time for an upgrade. Sometimes, it's as simple as wanting to present a more polished, modern image to your clients. That alone is a great reason to make a change.

Identifying the Tipping Point

The first step is just recognizing that your paper system is holding you back. Do any of these common growing pains sound familiar?

- You're Drowning in Paperwork: Manually writing dozens of receipts a day isn't just tedious; it's a recipe for errors and wasted time.

- Organization is a Nightmare: Stacks of carbon copy books make it tough to quickly find a specific transaction for a customer query or, even worse, during tax season.

- You Want to Look More Professional: A clean, branded digital receipt instantly elevates how clients see your business compared to a handwritten slip.

- Your Records are at Risk: Physical receipt books can be lost, stolen, or damaged by a simple coffee spill, putting your crucial financial records in jeopardy.

If you found yourself nodding along to any of these, you've likely outgrown your paper system.

Making a Smooth Transition to Digital

Switching over doesn't have to be some massive, complicated project. You can ease into it. The goal is to find a tool that genuinely makes your life easier, not one that comes with a steep learning curve or a big price tag.

The best way to make a change is to try it out with no risk. Starting with a tool that doesn't ask for your credit card or even an email signup lets you experiment and see the benefits for yourself before you commit.

This is where a free online tool is the perfect first step. For instance, ReceiptMake offers a simple, no-signup platform that lets you create professional receipts in seconds.

The process is about as straightforward as it gets:

- Pick a template that fits what you're selling.

- Fill in the details like your business info and the sale items. The tool does all the math for you.

- Download and send the finished PDF to your customer or save it for your own records.

Starting this way immediately improves your record-keeping. If you're curious about the tech that makes this possible, learning how OCR for receipts works can be pretty insightful.

You can test the waters, create a few receipts for your next couple of sales, and see how much more efficient it is. If you're ready to give it a shot, you can generate a professional receipt for free and see just how easy the upgrade can be.

Frequently Asked Questions

It's natural to have questions when you're managing transaction records, whether you're using a classic receipt book or thinking about going digital. Let's clear up a few common uncertainties.

Is a Handwritten Cash Receipt Legally Valid?

You bet it is. A handwritten receipt is a perfectly legitimate legal document, but only if it includes all the necessary details.

For it to stand up as proof of payment, make sure it clearly lists the date, the amount paid, who paid it, what the payment was for, and your signature. Tax agencies like the IRS have no problem with handwritten receipts for audits or expense claims, as long as everything is legible and complete.

Can I Use a Digital Receipt for All Business Transactions?

Absolutely. Digital receipts are the new normal and are accepted for just about every business purpose, from bookkeeping to tax returns. In fact, many people prefer them because they’re clean, secure, and a breeze to organize.

Think about it: a digital parking receipt provides the same proof as that little paper stub you always lose, but it's impossible to misplace in your inbox. Most businesses now default to digital, only printing a paper copy when someone asks.

What Is the Most Important Rule for a Cash Receipt Book?

If you take away just one thing, let it be this: consistency. You have to get into the habit of recording every single cash transaction, no matter how small. This is the bedrock of good financial tracking.

Being consistent means your books are always complete. It helps you account for every dollar coming in and builds a financial history you can actually trust. It's a simple discipline that saves you from massive headaches later on.

This means filling out every receipt completely, keeping the numbered copies in order, and balancing your book against your cash on hand. Using a standard cash receipt template is a great way to make sure you never skip over the important details.

Ready to make your record-keeping easier? ReceiptMake gives you a fast, free, and totally private way to create professional receipts in seconds. With over 100 templates and no sign-up needed, you can generate, download, and send perfect receipts right away. Give it a try at https://receiptmake.com.