Receipt Tracking for Small Business A Practical Guide

That shoebox overflowing with faded receipts? It’s not just messy—it’s actively costing you money. Proper receipt tracking for small business is about ditching the manual chaos for a digital system that gives you back your time, nails every tax deduction, and offers the financial clarity you need to actually grow.

Why Your "Shoebox" System Is Holding You Back

If you’re still clinging to paper receipts, you’re not just dealing with an organizational headache; you're actively draining your business's potential. Every crumpled receipt in a glove box or forgotten invoice buried in your inbox is a missed opportunity and a real financial risk.

Think about all the hours spent manually sorting, entering, and trying to make sense of those little slips of paper. It adds up fast. This isn't just admin work; it's precious time you could be spending with customers, creating new products, or, you know, making money. The cost of this lost time is often hidden, but it hits your bottom line just the same.

The Real Price of Being Disorganized

Let’s play out a common scenario. You buy a new piece of equipment for the business—a significant but necessary expense. You toss the receipt in a folder, promising to deal with it "later." Weeks become months, and when tax season rolls around, that crucial piece of paper is long gone. Without it, you can’t claim a perfectly legitimate deduction, which means you're literally just giving extra money to the government.

This happens all the time. In fact, by 2025, getting a handle on receipts has become a make-or-break issue for small businesses. A staggering 60% of small business owners say they spend way too much time on manual receipt work, creating huge inefficiencies and dangerous blind spots in their finances. You can dig deeper into these findings on the importance of receipt tracking on Apps365.com.

The real problem with a manual system isn't just the clutter. It's the financial fog it creates. When you don't have a clear, up-to-the-minute view of your expenses, you can't make smart decisions about your budget, pricing, or next big move.

It's More Than Just Missed Deductions

The danger goes beyond tax season. Messy records are a huge red flag for audits, which are every business owner's nightmare. An auditor won't just take your credit card statement as proof; they want to see an itemized receipt showing exactly what you bought. Trying to produce that on demand from a shoebox is next to impossible and invites a world of stress and potential penalties.

Let’s make this crystal clear. The old way of doing things is a trap. Before we dive into the solution, take a look at how the two approaches stack up.

Manual vs Digital Receipt Tracking: A Quick Comparison

This table shows the stark difference between clinging to the old "shoebox" method and adopting a smart digital system. The contrast in time, accuracy, and peace of mind is pretty revealing.

| Aspect | Manual Method (The Shoebox) | Digital System (The Smart Way) |

|---|---|---|

| Time Investment | Hours per month sorting, entering data, and reconciling. | Minutes per week snapping photos and letting software do the work. |

| Accuracy | High risk of typos, lost receipts, and calculation errors. | Near-perfect accuracy with automated data extraction (OCR). |

| Audit Readiness | A frantic, stressful search for documents. A nightmare. | Instant access to searchable, organized, and compliant records. |

| Real-time Data | None. You only know your numbers long after the fact. | Up-to-the-minute view of your spending for better budgeting. |

| Storage & Security | Vulnerable to loss, fire, flood, or just fading ink. | Securely backed up in the cloud, accessible from anywhere. |

Looking at it this way, it’s obvious that sticking with a manual system is a losing game.

At the end of the day, moving to a modern receipt tracking system isn't about adding another chore to your list. It’s a strategic move to protect your profits, reclaim your most valuable asset—your time—and build a stronger, more transparent business.

Creating Your Digital Capture System

Let's be honest, that shoebox full of crumpled receipts isn't a system—it's a problem waiting to happen. The first step to getting your business expenses under control is to build a simple habit: capture everything, immediately.

This isn't about adding some complicated new workflow to your already busy day. It’s about making a small change that prevents the headache of lost receipts from ever starting. The goal is to create a single, reliable entry point for every expense, whether it's a paper receipt from a coffee run or a PDF invoice from a software subscription.

The whole system hinges on immediate digital capture. If you wait until the end of the day or week, you've already lost. Receipts disappear, you forget what a purchase was for, and a tiny task turns into a huge, dreaded chore. By capturing receipts right when you get them, you trade a major administrative burden for a quick, two-minute habit.

Choosing Your Mobile Capture Tool

Your smartphone is the best tool you have in the fight against paper clutter. A good mobile scanning app can turn your phone's camera into a high-quality scanner, giving you a crystal-clear digital copy in seconds.

When you're picking an app, make sure it has these features:

- Automatic Edge Detection: The app should be smart enough to find the receipt's borders on its own, so you're not stuck manually cropping every image.

- Perspective Correction: It needs to straighten out the image, even if you took the photo at an odd angle. This makes it look like a proper flatbed scan.

- Image Enhancement: Look for features that boost contrast and get rid of shadows. The final scan has to be perfectly clear and easy to read.

This infographic lays out the painful journey of a manually tracked receipt. It’s a common story that ends in lost deductions, wasted hours, and needless stress come tax time.

As you can see, failing to capture a receipt right at the start creates a domino effect of problems. A solid digital capture system stops this chaos before it can begin.

Establish a Dedicated Email for Invoices

Digital receipts can vanish just as easily as paper ones, especially when they’re buried in a crowded inbox. The fix for this is incredibly simple: create a dedicated email address used only for receipts and invoices. Something like invoices@yourbusiness.com or receipts.yourbusiness@gmail.com works perfectly.

Tell all your online vendors and subscription services to send their invoices there. Just like that, you’ve created a centralized digital file cabinet for all your e-receipts. It stays clean and separate from your day-to-day emails, so you can always find exactly what you're looking for.

Pro Tip: I recommend setting up an auto-forwarding rule in your main email. If an invoice accidentally lands in your primary inbox, the rule will automatically shoot it over to your dedicated receipt address. Nothing gets lost.

Implement a Smart File Naming Convention

Okay, you've scanned the receipt. Now, what do you name the file? IMG_2034.jpg is completely useless. A consistent naming convention, however, turns your digital folder into a searchable database.

Here’s a simple format that works wonders: YYYY-MM-DD_Vendor_Amount

For instance, a receipt from a hardware store on October 26, 2024, for $85.40 would become: 2024-10-26_HomeDepot_85.40.pdf

With this structure, you can sort your files by date in a single click, search for all expenses from a particular vendor, or see the cost without ever opening the file. This little bit of discipline pays off big time during tax prep or when an auditor comes knocking. If you're also creating invoices or quotes, it's worth looking into customizable receipt templates for small businesses to keep all your financial documents looking professional and consistent.

Building the Capture Habit

The tools are easy, but the real secret to making this work is consistency. You have to build the muscle memory of digitizing every single receipt the moment it lands in your hand.

Here are a few rules I live by:

- The "Scan Before You Drive" Rule: Got a receipt for gas or parking? Scan it before you even put the car in drive.

- The "Receipt with Your Change" Rule: When the cashier hands you change and a receipt, scan it right then and there, before you even put your wallet away.

- The "End of Meal" Rule: At a business lunch, scan the itemized receipt as soon as you've paid the bill.

It might feel a little awkward for the first week, but it quickly becomes second nature. This one habit is the absolute bedrock of a stress-free financial system for your business.

Building an Audit-Proof Digital Filing Cabinet

Snapping a picture of a receipt is just the start. If you don't have a smart, secure place to put it, you're just swapping a physical shoebox for a digital junk drawer. The real work begins now: building a digital filing cabinet that's organized, scalable, and ready for anything—especially an audit.

Think about it like setting up a workshop. You wouldn't just throw all your tools into a pile on the floor. You’d get a toolbox, maybe a pegboard, and group everything by function so you can grab what you need without thinking. Your receipts need that same level of care to be useful when it matters most.

This isn't about creating some ridiculously complex system you'll abandon in a week. It’s about a simple, repeatable process that becomes second nature. The goal? To find any receipt from the last three years in under 30 seconds. With a solid setup, that’s not just a pipe dream; it's easy.

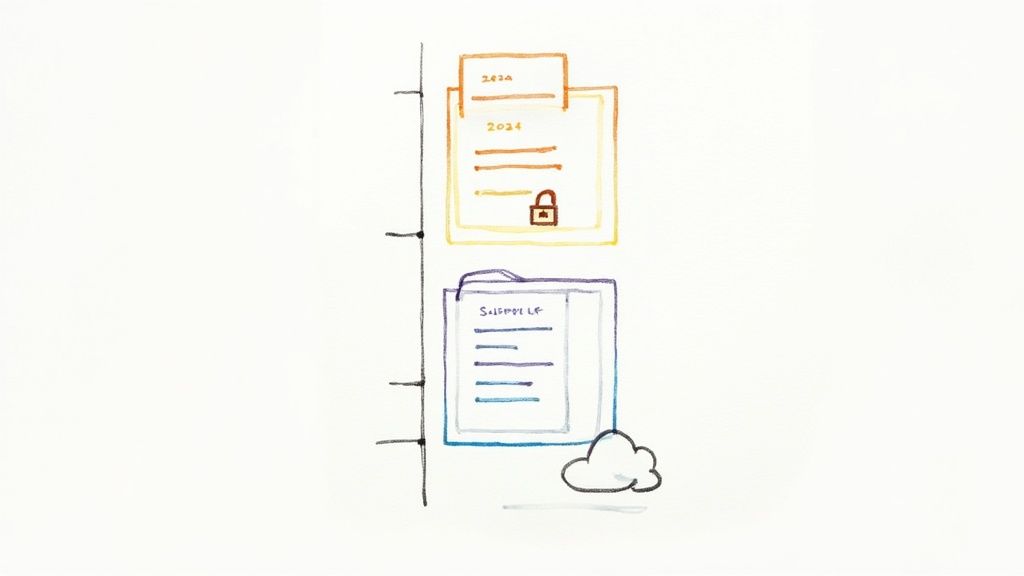

Cloud Storage vs. Dedicated Software

First things first, you need to decide where this digital cabinet will live. You've basically got two paths to choose from, and each has its pros and cons.

- Simple Cloud Storage (Google Drive, Dropbox): This is the DIY route. It's incredibly flexible and cheap, especially if you're already paying for a service like Google Workspace. You get total control over how you organize everything. The catch? All the responsibility for security, backups, and getting the data into your books is on you.

- Dedicated Expense Software (QuickBooks, Zoho Expense): These platforms are purpose-built for this exact job. They usually come with receipt scanning, automatic data reading (OCR), and slick integrations with your accounting software. The trade-off is a monthly subscription and a bit less freedom to organize files exactly how you want.

Honestly, for most folks just starting out, a well-organized cloud storage system is a fantastic, budget-friendly way to go. As your transaction volume picks up, you can always graduate to a dedicated tool to save more time.

The Ultimate Folder Structure for Clarity

If you're going the cloud storage route, a logical folder structure is the key to everything. It's the skeleton of your entire system. I've seen people try all sorts of things, but one layout has proven itself time and time again for finding receipts in a hurry.

The magic formula is: Year > Month > Expense Category.

Here’s what that looks like in the real world:

- Start with a main folder called "Business Expenses."

- Inside that, make a folder for the current year, like "2024."

- Within the "2024" folder, create folders for each month. Name them with numbers first so they sort correctly: "01-January," "02-February," etc.

- Finally, inside each month's folder, create subfolders for your main spending categories. Think "Office Supplies," "Meals & Entertainment," "Software," and "Travel."

So, a receipt for a new printer bought in October 2024 would be saved here:Business Expenses > 2024 > 10-October > Office Supplies

This layered approach makes finding things a breeze, whether you're searching by keyword or just clicking through folders. And if you ever need to create a proof of purchase for an expense you forgot to record, you can use an online tool to generate a professional receipt and file it away in the right spot.

By organizing your files this way, you're essentially doing your bookkeeper's—or an auditor's—job for them. A clear, logical trail of documentation shows professionalism and transparency, which can make any financial review go much smoother.

Backups and Security Are Non-Negotiable

Let's be clear: your financial records are one of your most critical business assets. Losing them to a crashed hard drive, a ransomware attack, or even an accidental "delete all" is simply not an option. This is where the "audit-proof" part of your filing cabinet becomes mission-critical.

Most big-name cloud providers do a great job with security on their end, but you still need to do your part.

- Enable Two-Factor Authentication (2FA): Turn this on for your cloud storage account right now. It adds a powerful layer of security to stop unauthorized access and takes about two minutes to set up.

- Set Up Automated Backups: Don't count on remembering to back up your files. Use a service that automatically syncs your main expense folder to a second location, like another cloud provider or an external hard drive. This is the 3-2-1 backup rule (three copies of your data, on two different types of media, with one copy off-site), and it's the industry gold standard for a reason.

Putting this digital cabinet together takes a little bit of effort upfront, but the peace of mind and time you'll save later is immeasurable. You'll thank yourself every month when you do your books, and you'll be incredibly relieved you did it if you ever get that dreaded letter from the IRS.

Let Automation Do the Heavy Lifting for You

Getting your receipts digitized is a great first step, but the real game-changer is letting technology handle the tedious parts. Automation is what turns that neat digital filing system into a smart, self-managing machine for your finances. This is where you really start to reclaim your time, shifting from hours of mind-numbing data entry to a few minutes of simple review.

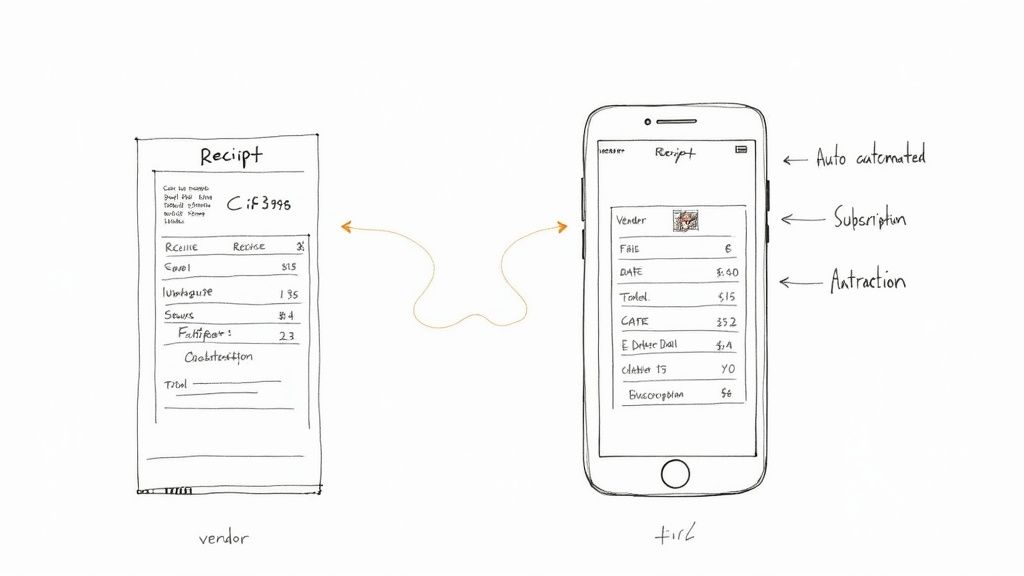

At the heart of this is a technology called Optical Character Recognition (OCR), which has gotten incredibly smart thanks to artificial intelligence. Just think of OCR as a tiny, super-fast assistant that reads pictures of your receipts. It instantly spots the vendor, date, and total amount, then plucks that information out and puts it right where it needs to go in your records. No more trying to decipher faded thermal paper or manually typing strings of numbers.

Picture this: you've just wrapped up a lunch meeting. You take a quick photo of the receipt with your phone. By the time you get back to the office, that expense has already been read, logged, and filed away under "Meals & Entertainment." This isn't some far-off future tech; it's how smart small businesses are handling receipts right now.

Smart Data Extraction That Just Works

When you add AI into the mix, receipt tracking goes from a chore to a background task. It’s no surprise that a 2025 Gartner survey found 60% of small businesses are already using AI-powered tools for this. Modern systems use OCR to grab receipt data with accuracy rates that often top 95%.

This is huge, because it wipes out the single biggest headache of manual bookkeeping: human error. A simple typo can throw off an entire month's books. A "5" mistaken for a "6" can cause a real reconciliation nightmare. When the machine handles the details with that level of precision, all you have to do is give it a quick once-over.

Automation has a dramatic effect on both the time spent and the accuracy of your bookkeeping. Moving from manual data entry to an AI-assisted workflow can cut down task time significantly while virtually eliminating common errors.

Impact of AI Automation on Receipt Tasks

| Task | Time Spent (Manual) | Time Spent (with AI) | Error Rate (Manual) | Error Rate (with AI) |

|---|---|---|---|---|

| Receipt Data Entry | 3-5 minutes per receipt | < 30 seconds per receipt | 5-8% | < 1% |

| Expense Categorization | 1-2 minutes per receipt | < 10 seconds per receipt | 3-5% | < 0.5% |

| Monthly Reconciliation | 2-4 hours | < 30 minutes | 10%+ | < 2% |

| Audit Preparation | 5-10 hours | 1-2 hours | High (missing docs) | Low (all docs linked) |

As you can see, the time savings alone are compelling, but the reduction in errors is what provides true peace of mind and financial clarity.

Create "Set It and Forget It" Rules

This is where automation gets really powerful—when you teach it the specifics of your business. Most modern expense apps let you create simple rules that automatically categorize expenses from vendors you use all the time.

For instance, you could set up rules like:

- Any charge from "GoDaddy" gets filed under "Web Hosting & Domains."

- If a receipt is from "The Home Depot," classify it as "Materials & Supplies."

- Transactions from "FedEx" are automatically tagged as "Shipping & Postage."

It only takes a few minutes to set these up, but they pay you back with hours of saved time every single month. All your recurring bills for software, fuel, and other predictable costs get captured and sorted perfectly without you doing a thing. Your monthly bookkeeping task goes from a major project to a quick check-in to spot anything unusual.

By setting up auto-categorization for your routine expenses, you build a system that's not just faster, but incredibly consistent. That consistency is gold when it comes to running accurate spending reports and making smart budget decisions.

Connect Everything to Your Accounting Software

The final piece of the puzzle is integration. Your receipt management tool shouldn't live on an island; it needs to talk directly to your accounting software, whether that's QuickBooks, Xero, or another platform.

This direct connection lets information flow seamlessly. As soon as a receipt is scanned and processed, all the data—including the receipt image itself—gets pushed right into your books. You've just eliminated double entry and ensured your accounting records are always current and perfectly matched to your source documents.

An integrated system gives you a single, reliable source of truth for your finances. The next time your accountant asks for backup on an expense, there's no frantic search through a shoebox or a messy folder. The receipt is already attached to the transaction in your accounting software, ready to go. And if you ever need to create a professional-looking receipt for a cash expense or a missing one, a free tool like ReceiptMake is a lifesaver for keeping your documentation clean and complete.

Making Sense of the Numbers: From Data to Decisions

Having a perfectly organized digital filing cabinet for your receipts is a huge win, but honestly, it’s only half the job. That data is just a pile of numbers until you actually look at it and learn from it. The real magic happens when you turn that raw information into financial intelligence that helps you steer your business.

And no, you don't need a finance degree or to lock yourself in a room with spreadsheets for hours. It all comes down to building a simple, repeatable monthly habit: a 30-minute financial check-in. This is what transforms reactive record-keeping into a proactive strategy for growth. It’s where you finally connect the dots between what you're spending and where your business is headed.

This regular review process catches small financial leaks before they turn into gushing holes in your budget. More importantly, it gives you the clarity to put your money where it will actually make a difference—something that's non-negotiable for staying in business and growing.

The 30-Minute Monthly Reconciliation Habit

The foundation of this whole process is reconciliation. It’s a fancy word for a simple concept: making sure the numbers in your receipt system match the transactions on your bank and credit card statements, dollar for dollar. Think of it as your monthly moment of truth.

Just setting aside a half-hour each month stops small mistakes from snowballing into a year-end accounting nightmare. It's a small habit that ensures your books are always accurate and ready for your accountant (or the tax man).

Here’s a simple checklist to run through:

- Get Your Statements: Download the latest monthly statements for all your business bank accounts and credit cards.

- Open Your Tools: Have your receipt tracking software or your neatly organized cloud folder open right next to your statements.

- Go Line by Line: Work your way down your bank statement. For each transaction, find the matching digital receipt in your system.

- Spot the Gaps: Do you see any charges on your statement that are missing a receipt? Or maybe you have receipts for purchases that haven't cleared your bank yet?

- Fix It Now: Immediately chase down any missing receipts. If a charge looks odd, investigate it on the spot. It could be an error or, worse, fraud.

This process is the fastest way to find any holes in your receipt-capturing routine and tighten up your financial controls.

From Simple Reports to Smart Decisions

Once everything is reconciled and accounted for, you can start asking the really important questions. Modern expense software like ReceiptMake makes it ridiculously easy to generate reports that show you exactly where your money is going. This is where you graduate from basic bookkeeping to actual strategic thinking.

By consistently reviewing your spending, you stop being a passenger in your business's financial journey and become the pilot. You can anticipate problems, identify opportunities, and make course corrections based on hard data, not just guesswork.

Start by pulling a few key reports:

- Expense by Category: This is often the most eye-opening report. It breaks down exactly what you spent on "Software," "Marketing," "Travel," and "Office Supplies." You might be shocked to see how much those "small" monthly subscriptions really add up to.

- Expense by Vendor: This report can be a goldmine for negotiation. If you see you're spending thousands with a single supplier, you probably have some leverage to ask for a volume discount or better terms.

- Spending Over Time: Compare this month's spending to last month's, or even better, to the same month last year. This helps you spot trends, like rising supply costs, so you can adjust your budget or pricing before it eats into your profits.

This level of detail is more critical than ever. With today's economic pressures, tracking every dollar is essential. In fact, recent research shows that over 74% of small business owners have seen their operating costs jump significantly year over year. As this small business expense tracking guide highlights, analyzing your reports is the best way to fight back, find areas to trim the fat, and protect your hard-earned profit margins.

Frequently Asked Questions About Receipt Tracking

Even with a solid system, you're bound to run into some specific questions about managing receipts. I've seen it time and time again with small business owners—getting the details right from the start is what saves you from massive headaches later on.

Let's walk through some of the most common questions I hear from entrepreneurs, with clear answers to help you handle things like a pro.

How Long Should I Keep Business Receipts?

This is easily one of the most important questions. For tax purposes in the U.S., the IRS generally says to keep your receipts for three years from the date you file your return. Think of this as your baseline.

But there are a couple of key exceptions. That timeline jumps to six years if you've underreported your gross income by more than 25%. And in the rare case of suspected fraud or not filing a return at all, you'll need to keep those records indefinitely.

This is where a digital system really shines. Paper receipts fade, get lost, or just take up a ton of space. Digital copies, on the other hand, are forever, easy to find, and keep you prepared for anything.

Are Bank Statements Enough for an Audit?

This is a huge and surprisingly common misconception. The short answer is no—bank and credit card statements are not a substitute for itemized receipts. Not even close.

Your bank statement proves a transaction happened. It shows the date, the vendor, and the amount you paid. But what it doesn't show is what you actually bought. That's the crucial detail an auditor needs to see to confirm it was a legitimate business expense.

A credit card statement might show a $200 charge from Staples. Was that a new office printer or a video game for your nephew? The itemized receipt tells the real story, proving you bought business supplies. That distinction is everything during an audit.

Bottom line: Always, always keep the full, itemized receipt. It's your only real proof.

What Is the Best Way to Handle Cash Receipts?

Ah, the dreaded cash receipt. These little slips of paper are notorious for vanishing the second they're stuffed into a wallet or pocket. Because they're so easy to lose, you have to deal with them immediately.

The only foolproof method is to digitize them on the spot.

- Snap a Photo: The moment you get the receipt, use your phone and a scanning app to capture a clear image. Don't wait.

- Upload It Now: Send that image straight to your cloud storage or expense app.

- Tag It as "Cash": When you categorize the expense, just make a quick note that it was a cash payment. This will save you a ton of confusion when you reconcile your accounts later.

This simple two-minute habit is the difference between capturing every cash expense and letting those valuable deductions slip through the cracks.

What Are the Biggest Receipt Tracking Mistakes?

Beyond just losing receipts, a few bad habits can completely wreck an otherwise decent system. Steer clear of these common pitfalls, and you'll be in great shape.

Here are the top three mistakes I see:

- Waiting Too Long: Piling up receipts to deal with "later" is a recipe for disaster. It turns a quick, daily task into a stressful, overwhelming chore. You're guaranteed to forget details or lose receipts.

- Being Inconsistent: Only scanning some of your receipts is almost as bad as scanning none. You're not only losing money on missed tax deductions but also working with a completely skewed picture of your business's finances.

- Using Vague Categories: Throwing everything into a "Miscellaneous" or "General" bucket makes tax time a nightmare. It also gives you zero useful insight into where your money is actually going.

The solution to all three? Build a simple, daily habit of capturing and categorizing every single receipt as it comes in. It’s the most effective fix there is.

Ready to stop worrying about shoeboxes and lost deductions? With ReceiptMake, you can create professional, accurate receipts for any expense in seconds, ensuring your records are always complete and audit-proof. Try our free receipt generator today and take control of your business finances.

Article created using Outrank