How to Track Business Expenses A Simple Guide

Here’s the thing about tracking business expenses: it’s really a simple four-part system. You need to separate your personal and business money, capture every single receipt, categorize all your transactions, and then review everything once a month. Once you get this rhythm down, you'll have a crystal-clear picture of your financial health and be more than ready for tax time.

Why Smart Expense Tracking Powers Your Business Growth

Let’s be honest—most people see tracking expenses as a total drag. But what if you saw it less as a chore and more as a strategic tool? That shift in mindset is the first real step toward building a more profitable, resilient business. This isn't just about stuffing receipts in a folder; it's about getting a real-time pulse on your company's financial heartbeat.

When you have that kind of clarity, you start making smarter, data-driven decisions. Instead of just guessing where the money went, you’ll know exactly which parts of your business are making money and which are just draining your resources. This is the kind of insight that leads to solid budgets and forecasts you can actually count on.

Beyond Bookkeeping: The Strategic Benefits

Getting a good handle on your expenses unlocks some serious advantages that go way beyond basic bookkeeping. Think of it as your best defense against the common money traps that trip up so many growing businesses.

Over time, these benefits really start to build on each other, creating a much stronger financial foundation for your company. Here’s what you gain:

- Maximized Tax Deductions: You’ll have a perfect, documented trail for every single write-off, making sure you don't overpay when tax season rolls around.

- Improved Cash Flow Management: Spotting spending patterns helps you manage your cash flow proactively. No more surprise shortages—just better use of your capital.

- Informed Budgeting: Your past spending becomes the blueprint for future budgets, making your financial plans way more realistic and achievable.

- Audit Preparedness: With clean, organized records, a potential audit becomes a minor inconvenience instead of a major crisis.

Effective expense management isn’t just about staying compliant; it's a core business function that directly impacts your bottom line. It turns reactive accounting into a proactive financial strategy, giving you the control you need to scale responsibly.

Avoiding Common Manual Tracking Pitfalls

Still clinging to that shoebox full of receipts and a clunky spreadsheet? That approach isn't just inefficient; it's genuinely risky. Manual systems are a breeding ground for human error, lost receipts, and even fraud. You’d be surprised how many businesses are still stuck in that cycle.

One of the biggest headaches is just trying to stay compliant. A 2025 report from GBTA revealed that a staggering 71% of finance leaders struggle with expense compliance and catching fraud, all because they're still using manual systems. It’s no wonder so many are finally moving to modern tools that automate the process and give them real-time oversight. You can dig into more business expense trends and statistics to see why the shift is happening so quickly.

Laying the Groundwork for Smart Expense Tracking

Before you can track a single dollar, you need a solid system. Getting this foundation right is easily the most important part of the whole process. This isn't about finding the fanciest software; it's about picking a method that actually works for your business and establishing a few core habits that will keep your finances in check for the long haul.

Trust me, a little bit of setup now saves you from a mountain of headaches later. It turns expense tracking from a chaotic, dreaded chore into a simple, almost automatic routine.

Choosing Your Expense Tracking Method

First things first: how are you actually going to log everything? For most small businesses, this boils down to using dedicated software or sticking with a good old-fashioned spreadsheet. There's no single "best" answer here—the right choice really depends on how complex your business is, how many transactions you have, and frankly, what you'll consistently use.

A freelance writer with a handful of clients might get by just fine with a spreadsheet. But if you're running a cafe with daily inventory orders and multiple staff members, trying to manage that manually will become a nightmare, fast. At a certain point, automation isn't just a nice-to-have; it's essential for staying accurate and sane. Research has shown that 80% of employees found automation let them focus on more important work, and that's exactly the goal here.

To help you figure out what makes sense for you, let's break down the common methods.

Choosing Your Expense Tracking Method

Deciding on the right tool is a crucial first step. Whether you opt for a simple spreadsheet or a powerful software solution depends on your business's scale and your personal workflow. This table breaks down the pros and cons of the most common approaches to help you make an informed choice.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Expense Tracking Software | Growing businesses, teams, and anyone wanting automation. | Real-time data, bank feed integration, receipt scanning, and automated categorization. | Monthly subscription fees and a potential learning curve during setup. |

| Spreadsheets | Sole proprietors, freelancers, or businesses with very low transaction volume. | Completely free, highly customizable, and requires no special software. | Prone to human error, time-consuming manual entry, and lacks real-time insights. |

Ultimately, the best method is the one you will use consistently. Start simple if you need to, and you can always upgrade to a more robust software solution as your business grows and your needs change.

The Single Most Important First Step

If you do only one thing after reading this article, please do this: open a dedicated business bank account. This is absolutely non-negotiable for any serious business owner.

Mixing your personal and business finances is the fastest way to create an accounting disaster. When your morning coffee and a major software subscription are sitting side-by-side on the same bank statement, untangling it all becomes a huge pain. It makes bookkeeping a mess, turns tax time into a nightmare, and can even put your personal assets at risk if your business ever faces legal trouble.

A separate account creates a clean, undeniable line between your personal life and your business operations. It’s the cornerstone of professional financial management and makes every subsequent step of tracking business expenses significantly easier.

Creating Your Chart of Accounts

Alright, you've picked your method and have a dedicated bank account. Now it's time to set up your Chart of Accounts. It sounds way more intimidating than it is. Really, it's just a list of categories you'll use to organize all your spending. Think of it as creating digital folders for your money.

Good categories give you a crystal-clear picture of where your money is actually going. Instead of one giant, vague "Office Supplies" bucket, you can get more specific. The goal is to create categories that are intuitive for you and give you real insights when you review your spending at the end of the month.

Here are a few practical examples to get you thinking:

- Software & Subscriptions: This is perfect for your project management tools (like Asana), cloud storage, and any other recurring software fees.

- Marketing & Advertising: Group your social media ad spend, email marketing services, and costs for printing flyers here.

- Travel & Meals: If you're a consultant, this would cover flights, hotels, and dinners with clients.

- Professional Development: A great spot for online courses, industry conference tickets, and membership dues.

- Cost of Goods Sold (COGS): Essential for any retail or e-commerce business. This is where you track the direct costs of the products you sell, like raw materials or inventory purchases.

Don't overthink it at the start. Begin with a simple list and let it grow with your business. You’ll quickly learn which categories are the most meaningful for understanding your unique spending habits, which is exactly what you need to build better budgets and make smarter financial decisions.

Your Daily Workflow for Receipts and Data

Having a system is one thing, but actually using it every day is what makes the difference. This is where you build the habits that create an audit-proof set of books. It’s all about making the process of capturing and recording expenses so simple and repeatable that it becomes second nature.

Forget about that shoebox stuffed with faded receipts. Today's tools make managing expenses fast, digital, and incredibly reliable. The goal is to get into a rhythm where snapping a photo of a receipt after a client lunch is as automatic as checking your email.

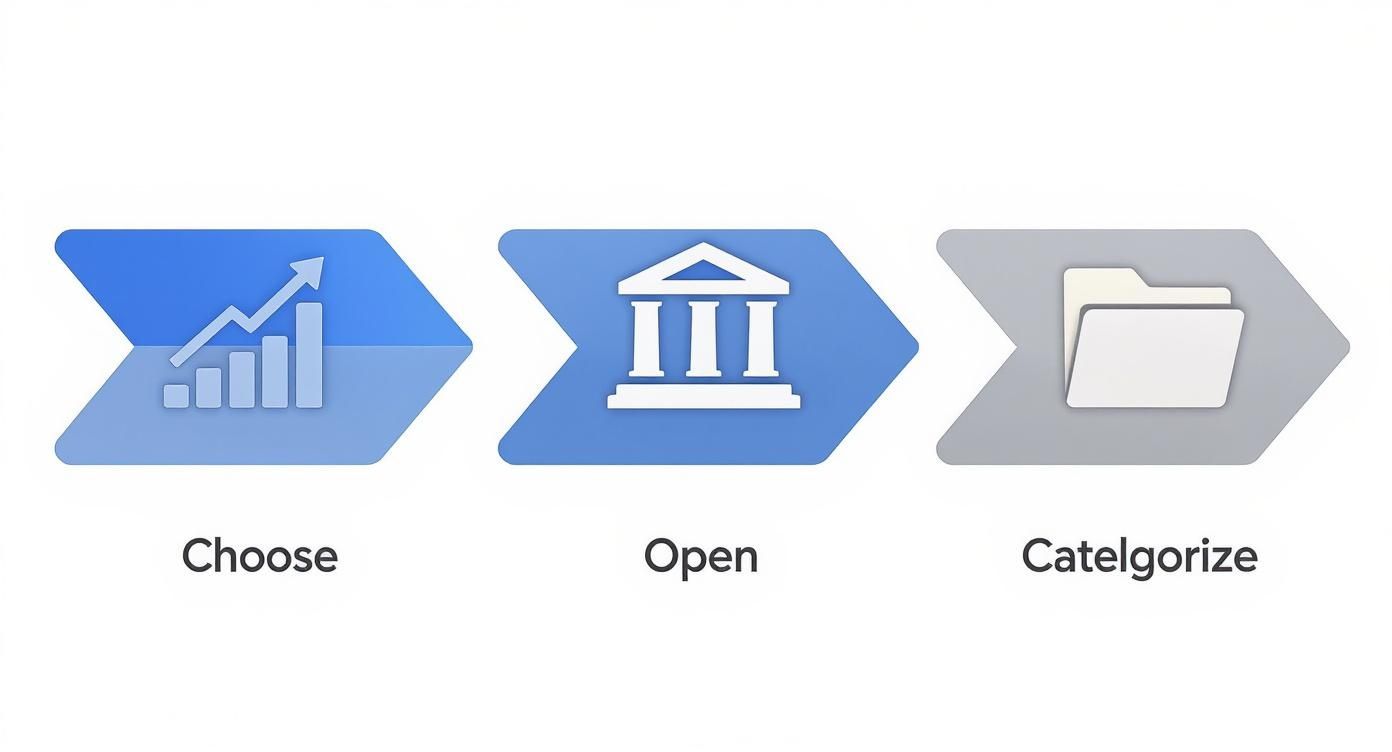

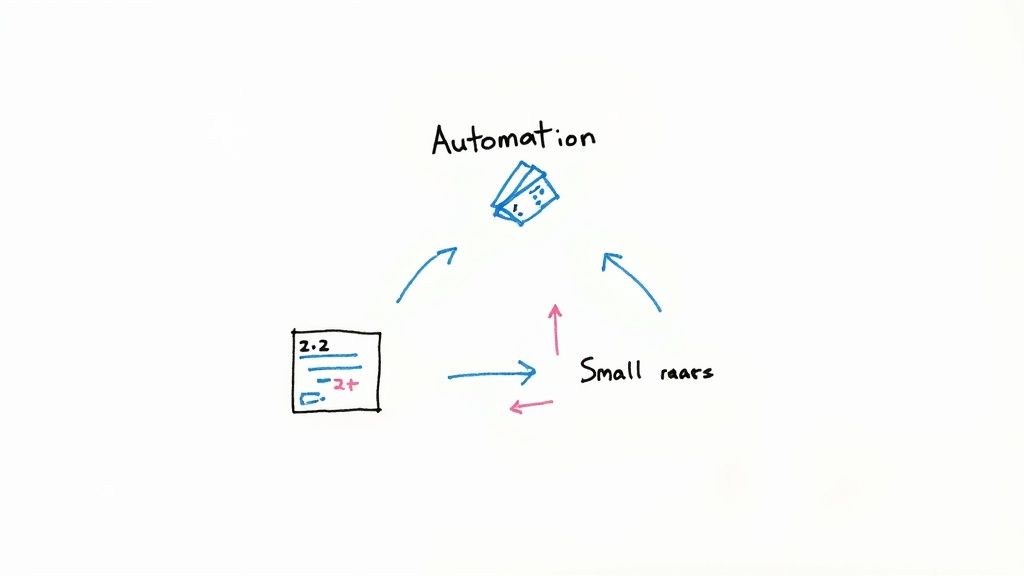

This infographic breaks down the essential steps for building a solid expense tracking habit, from picking your tools to sorting your transactions.

As you can see, it all starts with making deliberate choices. The right software, dedicated accounts, and a clear organization system are the pillars that hold up your financial clarity.

How to Capture Every Single Receipt

Your smartphone is probably the best expense-tracking tool you own. Apps like Expensify or Dext use your phone's camera and something called Optical Character Recognition (OCR) to scan a paper receipt and instantly pull out the key details—vendor, date, and amount. Just like that, your record is digitized, searchable, and safely stored.

For all those online purchases and emailed invoices, you can set up a simple filter in your inbox. I recommend creating a rule that automatically forwards any email with the word "receipt" or "invoice" to a specific folder or right into your expense app. It’s a hands-off way to create a perfect digital paper trail.

What to Do When a Receipt Goes Missing

It happens. You pay for parking in cash, grab the little ticket, and by the end of the day, it's gone. Don't just write off the expense—document it. The trick is to create a record of the transaction as soon as you realize the original receipt is lost.

This is where a digital substitute comes in handy. You can use a tool to generate a new record that accurately captures all the necessary details of the purchase. You can find some fantastic, professional-looking options by browsing different receipt templates available online.

The IRS often cares more about having a credible, consistent record than a perfect paper trail. A detailed note explaining why a receipt is missing, written at the time of the expense, is much better than a gap in your books. Always remember to jot down the "who, what, when, where, and why."

Whether you have a pristine digital copy or a carefully reconstructed one, the goal is the same: a complete and defensible record of every business expense.

The Must-Have Details for Every Transaction

Every time you log an expense, you need to capture a few key pieces of information. This isn't just for your own sanity; it's exactly what tax authorities look for to confirm that a deduction is legitimate. Getting this right from the start saves a world of pain later.

Make sure every entry includes:

- Date: The exact day the purchase was made.

- Vendor: Who you paid.

- Amount: The total cost, including any tax or tip.

- Category: Where it fits in your Chart of Accounts (e.g., "Office Supplies," "Meals & Entertainment").

- Business Purpose: A quick note explaining why it was a business expense. "Lunch with Jane Doe re: Q3 project" is perfect.

This level of detail is what separates a hobby from a business in the eyes of an auditor. Being specific and consistent is your best defense.

Letting Technology Do the Heavy Lifting for You

Alright, you've got a daily routine down. Now, let's make your life even easier by letting technology take over the repetitive stuff. Setting up a few automated systems is the key to moving from constantly doing the work to simply overseeing a smooth, efficient process. A couple of hours invested upfront can genuinely change your relationship with expense tracking, turning it from a dreaded chore into something that just... happens.

This isn't just about saving time; it's about accuracy. Automation is your tireless assistant, making sure nothing gets missed while you’re busy actually running your business.

Connect Your Bank Feeds for Automatic Imports

If you do only one thing to automate your finances, make it this: connect your business bank and credit card accounts directly to your accounting software. This is called a bank feed, and it’s a total game-changer. It automatically pulls every transaction into your software, which means you can say goodbye to manual data entry forever.

Imagine logging in and seeing a clean list of all your recent transactions waiting for you, instead of having to type them in one by one. It gives you a real-time pulse on your spending and ensures no expense ever slips through the cracks.

Of course, there are always cash purchases or moments when a receipt goes missing. For those situations, having a backup is crucial. You can use a free receipt generator to create a clean, professional record and keep your financial history complete.

Teach Your Software with Smart Rules

With transactions flowing in automatically, the next trick is to teach your software how to categorize them for you. Most modern accounting platforms let you create "rules" that handle recurring expenses without any input from you.

Think about all the bills you pay month after month. You can set up a rule once, and it's handled correctly every time.

- Software Bills: Make a rule that automatically tags any charge from "Dropbox" or "Microsoft 365" as a "Software & Subscriptions" expense.

- Utilities: Tell your software that any payment to "City Power & Light" should always be categorized under "Utilities."

- Ad Campaigns: Set a rule to classify every charge from "Meta" or "Google Ads" as "Marketing & Advertising."

Think of it like programming a smart assistant. You teach it your habits once, and it takes care of the tedious sorting from then on. This frees you up to analyze the bigger picture instead of getting stuck in the weeds.

Use AI as Your Financial Watchdog

Today's expense tools are getting smarter, using artificial intelligence to act as a second pair of eyes on your finances. These systems go beyond just sorting transactions—they actively hunt for potential issues that you might otherwise miss.

AI can learn your typical spending patterns and flag anything that looks out of place. It might spot a duplicate charge from a supplier or an expense that doesn't align with your company’s spending policy. This kind of proactive monitoring helps you catch small errors before they snowball into big problems.

The savings can be substantial. Studies show that businesses using AI-driven expense systems can save an average of $75 per expense report thanks to better accuracy, fraud detection, and less manual work. These tools give you a much clearer view of where your money is going, helping you make smarter decisions. If you're curious about where this is all heading, you can learn more about the future of expense management trends on Superagi.com. By adopting these tools, you’re not just tracking expenses—you’re building a strategic financial oversight system.

Your Monthly Review for Financial Clarity and Tax Prep

Tracking every dollar is a great start, but the real magic happens when you actually use that information. A monthly financial review is where the numbers on your screen become real business intelligence. This isn’t about getting lost in spreadsheets for days on end; it’s a focused check-in that brings clarity, catches mistakes, and makes tax season surprisingly painless.

Think of it as a quick health checkup for your business. By setting aside just an hour or two each month, you build a powerful habit. You'll stop reacting to financial surprises and start proactively guiding your business, knowing exactly where you stand.

The Art of the Monthly Reconciliation

First things first: reconciliation. This is the most important part of your monthly review. It’s simply the process of making sure the numbers in your expense records perfectly match your official bank and credit card statements. It’s your financial safety net, designed to catch problems before they grow.

This simple routine uncovers all sorts of common issues that are easy to miss in the daily grind. You might find a vendor accidentally double-charged you, spot a subscription you forgot about, or even catch a fraudulent transaction. Finding a $50 error might not feel huge, but those little mistakes can really add up over a year.

Here’s a simple way to tackle it:

- Gather Your Docs: Pull up your monthly statements for your business bank accounts and all credit cards.

- Go Line by Line: Open your expense tracker or spreadsheet and compare each transaction from your bank statement to what you have recorded.

- Check It Off: As you confirm a match, mark it as "reconciled" or "cleared" in your software. This feels good.

- Hunt Down Mismatches: If something on your statement isn't in your records (or vice-versa), figure it out right away. Did you forget to log a cash purchase? Is it a bank error?

This process ensures your financial data is always accurate and trustworthy, which is the foundation of any good business decision.

Understanding Your Profit and Loss Statement

Once your accounts are reconciled, you can confidently run a Profit & Loss (P&L) statement. This report is the ultimate summary of your financial performance for the month. It simply subtracts your total expenses from your total revenue to show if you made a profit or took a loss.

Reading a P&L tells you the story of your business that month. You’ll see exactly how much you spent on marketing versus software, or how travel costs hit your bottom line. It answers the most fundamental question in business: "Am I actually making money?"

Don't let the term "P&L statement" intimidate you. It’s not just for accountants. It's a practical tool for every business owner that gives you a clear, high-level view of your financial health, helping you spot trends and make smarter spending decisions.

For example, a quick glance at your P&L might show that your "Software & Subscriptions" category is slowly creeping up. That little insight could prompt you to audit your tools and cancel services you're not using, instantly boosting your profit.

Building Your Year-Round Tax Prep System

One of the best side effects of a consistent monthly review is that you’re essentially preparing your taxes all year long. When tax season rolls around, you won't be digging through a chaotic shoebox of receipts. Instead, you'll have 12 clean, reconciled monthly reports ready to hand over.

A huge part of this is keeping a running tab of your tax-deductible expenses. As you categorize transactions each month, you're automatically building a detailed record of every potential write-off, making it easy to maximize your deductions and lower your tax bill.

Pay close attention to travel expenses, as they often require more detailed records for the IRS. For instance, if you’re traveling for a conference, keeping a clear record of your stay is non-negotiable. If a receipt gets lost, you can always use a professional hotel receipt template to recreate a document for your records, ensuring you’ve captured all the necessary details.

This proactive approach turns tax time from a dreaded, stressful event into a simple final review. By doing a little bit of work each month, you save yourself a massive headache down the line.

Common Questions About Tracking Business Expenses

Even with the best system in place, you’re going to have questions. When you're just learning the ropes of tracking business expenses, some of the day-to-day realities can feel a bit confusing. I've put together answers to the most common hurdles I see business owners face.

Think of this as your go-to reference for those tricky situations. We'll cover everything from handling cash purchases to knowing how long to hang onto your records, so you can manage your finances with total confidence.

Here are some answers to the most common questions we hear.

| What is the best way for a freelancer to start tracking expenses? | How long should I keep my business receipts and records? | Can I claim expenses paid with personal funds? | What are some common expense tracking mistakes to avoid? |

|---|---|---|---|

| Start simple to build a habit. Open a dedicated business bank account and use a basic spreadsheet or user-friendly software like FreshBooks. Consistency is more important than a complex system at the beginning. | The IRS generally requires you to keep records for three years from your tax filing date. However, it's a smart practice to keep digital copies for at least seven years to be safe, as some situations have a longer audit window. | Yes, but you need to do it correctly. Pay for the item with personal funds, document it as a business expense, and then formally reimburse yourself from your business bank account. This creates a clean paper trail. | The biggest mistakes are mixing personal and business funds (commingling), keeping vague records (e.g., not noting the purpose of a purchase), and procrastinating until tax season to organize everything. |

Getting these basics right will save you countless headaches down the road. It's all about creating clear, consistent habits that make managing your money second nature.

How Should a Freelancer Get Started?

For freelancers or solo operators, the best starting point is whatever is simple enough that you'll actually do it. Don't get bogged down trying to build the perfect, complex system from day one. Your only goal at the start is to build a habit.

The single best thing you can do is open a dedicated business bank account and get a business credit card. This one move immediately separates your personal and business finances, which makes everything else a thousand times easier.

After that, you've got two great options:

- A Solid Spreadsheet: It costs you nothing and works beautifully. Just create columns for the date, vendor, amount, category, and a quick note about the business purpose.

- Simple Accounting Software: Tools like QuickBooks Online are built for this. They link right to your business account and automate a ton of the work for you.

Whatever you choose, the magic is in consistency. Block out just 15 minutes every Friday to log your spending and upload receipts. This small, weekly ritual is the secret to avoiding a massive year-end panic.

How Long Do I Need to Keep Receipts and Records?

This is a huge one, and getting it wrong can have real consequences. The IRS has clear guidelines on how long you need to keep financial records like receipts, invoices, and bank statements.

As a general rule, you need to hold onto your records for at least three years from the date you filed your tax return. This is the standard window the IRS has to audit you.

But be careful—there are exceptions. If you happen to underreport your income by more than 25%, the IRS has up to six years to take a look. I always advise clients to err on the side of caution. Keep digital copies of everything for at least seven years, just to be safe.

This is where digital storage becomes your best friend. Scan your paper receipts or use an app to snap photos. You’ll never have to worry about ink fading or a crucial piece of paper getting lost.

What if I Paid for a Business Expense with Personal Money?

It happens to everyone. You're out and about, grab something for the business, and accidentally use your personal card. The good news is, yes, you can still claim it—you just have to document it carefully.

The key is to formally reimburse yourself from your business account. This creates the clean paper trail you need to prove the business officially paid for the item.

Here’s how that works in practice:

- Document the purchase. Keep the receipt and log it in your expense tracker just like any other business expense.

- Create a reimbursement request. This can be as simple as a note in your records showing the business owes you for the purchase.

- Make the transfer. Move the exact amount from your business bank account to your personal one. Be sure to label the transaction something clear, like "Owner Reimbursement for Office Supplies."

This little dance is exactly why having a separate business account is so crucial—it helps you avoid these extra steps.

What Are the Most Common Tracking Mistakes to Avoid?

Sometimes, knowing what not to do is just as valuable. I see a lot of new business owners make the same handful of preventable mistakes.

The absolute biggest one is commingling funds. Using one bank account for both business and personal life is a recipe for an accounting disaster. It also puts your personal assets at risk if your business ever faces legal trouble.

Another classic error is keeping records that are too vague. A credit card statement that just says "Amazon - $200" tells you nothing. You need proof of what you bought and a note about why it was a necessary business expense.

Finally, don't put it off. Procrastination is the sworn enemy of good bookkeeping. Trying to sort through a year's worth of crumpled receipts in April is a nightmare. A little bit of work each week makes the process painless and your records infinitely more accurate.

Tired of manually creating records for cash purchases or lost receipts? ReceiptMake offers a fast, free, and incredibly simple solution. Generate professional, accurate receipts in seconds from over 100 templates to keep your financial documentation complete and audit-proof. Create your first receipt now.

Article created using Outrank